It’s been five years, and your first HDB BTO flat has now met its minimum occupancy period (MOP). Finally, it can now be sold on the open market and you can (hopefully) turn a tidy profit from it.

But before you start dreaming of dollar signs and hearing ‘ka-ching’s, remember that it’s not just you who is looking to sell your HDB BTO flat after MOP. All of your neighbours in your estate can now do so too. For every HDB BTO project, there could potentially be hundreds and thousands of individual home owners residing within that can now have the option to sell.

Hence, it’s good to know what the competition is like and how you can maximise your chances of making a good sale. If you die-die want to sell your home of five years, here are some useful insights and options for you. Read on.

Up to 50,000 HDB Flats reaching MOP in 2020 and 2021

This year alone, an estimated 20,000 previously launched HDB BTO flats will reach the end of their MOP. According to a The Business Times report, the figure for 2019 was 27,000 and from 2020 to 2021, there could be as many as 50,000 HDB BTO flats that can be put up for resale.

HDB MOP: 24 BTO Projects You Can Buy That MOP-ed in 2020

Read more here.

In comparison, during the years of 2013 to 2014, there were just 9,000 HDB BTO flats that reached MOP.

With so much potential supply of HDB resale flats, could this mean that HDB resale flat prices will also drop? Well, figures for 2020 probably aren’t the most accurate due to the ongoing COVID-19 outbreak. But if it’s any comfort, The Straits Times reported that the number of HDB resale transactions in July remained high, even beating that in the same period in 2018.

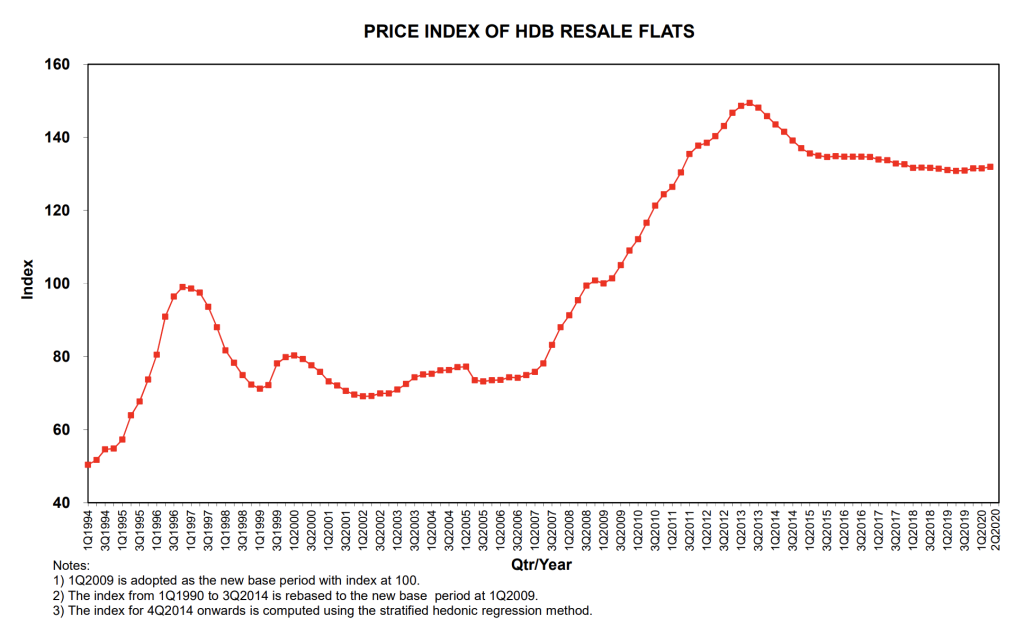

Source: HDB

So people are still buying HDB resale flats. And there’s a chance that they won’t want to wait for 1) a HDB BTO project to launch in their preferred area, and 2) another four to five years before their new flat is built.

If you’re concerned about whether this influx of HDB resale units will take a toll on the price of your newly-MOPed home, the HDB resale price index (above) seems more or less flat in the past five years.

You will also notice that the HDB price index was steadily increasing till it hit its peak in 2012, shortly after which, the government stepped in and introduced a slew of cooling measures. HDB has also been holding back on releasing new BTO flats in order to focus more on existing and older flats. Over the next decade, an average of 17,000 to 19,000 HDB BTO flats will reach MOP each year.

Avid followers of property news (and PropertyGuru guides) will also know that there’s been a trending increase in private home sales — and most of the buyers are Singaporeans. We can’t say for a fact how many are buying for investment, first-timers, getting their second property, or HDB upgraders, but you will probably find a good mix of each archetype.

Notes Teng Hui Li, an agent with PropNex Realty: “When more flats reach MOP, there is higher demand from HDB upgraders looking to move to private homes. Naturally, most people would want an upgrade in their standard of living, especially if their flats are sitting on profits and they are financially capable of doing it.”

“It seems to be a trend now, especially when most of [the HDB upgraders’] family members and friends are doing that, many will follow suit,” she adds.

However, other agents report that they don’t see more HDB upgraders who want to move into private homes, a likely result of the COVID-19 situation.

So, is selling your HDB BTO flat once it has reached MOP the right thing for you? And is upgrading to a condo or buying a new HDB BTO in a better area what you need? We answer these burning questions below.

First of all, should you sell your flat right after MOP?

If you’ve been raring to put your HDB BTO on the market the moment you reach MOP, this section is for you.

Having read our above preamble about the bumper crop of fellow HDB BTO flats that have reached/will be reaching MOP soon, you could be worried about over-supply despite the promising demand.

However, while property agents have been receiving more enquiries from keen sellers, this is perfectly normal, notes Azhar Sulaiman, marketing director at PropNex Realty. In fact, if not for COVID-19 and the resultant recession, he feels that the number of enquiries would be even higher.

How popular would your flat be?

According to our search data, the most sought-after type of home on the HDB resale market are newly-MOP-ed flats. These are the newest (just five years old) and come with the longest lease (99 minus 5 years). They are also more expensive than the older flats that have 60 or fewer years left on the lease.

While there is demand, you need to be prepared for competition from your fellow just-MOP-ers, some who have a nicer interior design (or better Photoshopped pics) than yours.

However, there’s a silver lining to everything. Hui Li says: “Buyers seem to be more attracted to the MOP flats rather than the older resale flats, and they are also concerned about the resale value in the future. Therefore, even when there are more newly MOP flats that are out in the market, we believe the demand will catch up with the supply.”

There are other compelling reasons for these buyers to choose newly-MOP-ed flats. Hui Li adds: “Especially in the current situation when COVID-19 delays the BTO flat completion, with some flats being completed up to seven years later, many buyers would not be able to wait. Plus, grants from the government are available as well.”

Azhar agrees. He says: “As there is a shortage of supply in the market right now, those hard-to-sell units will be easier to sell and those easy-to-sell units can expect some cash over valuation (CoV). There are more buyers right now as compared to before the COVID-19 circuit breaker.”

He also expects other “rare” HDB flats like executive maisonettes to be popular.

Tips for selling your flat right after MOP

But if you’re serious about selling your flat, do it ASAP. Hui Li observes that there is currently a surge in demand from HDB resale buyers, and hence an increase in HDB transaction volume and price these few months.

Azhar adds: “If your unit is renovated, you can demand for some CoV depending on how extensive the renovation is. For those using HDB issued floorings, if you overlay them with vinyl flooring, this could instantaneously be more attractive to buyers and may even bump up the price of the flat.”

Make sure you’re getting your money’s worth

Do your sums before you sell. And do them well.

Take into account any fees you need to pay, plus the money you need to refund to HDB, your CPF account, and even make up for the accrued CPF interest that you would have earned. And did you factor in the amount of money you spent on renovation?

Don’t count on the HDB resale prices making a dramatic increase though, unless you’re one of the lucky owners of a potential million-dollar HDB resale flat.

After selling, you can BTO again.

Yes, you can buy a second HDB BTO flat. However, as always, there are a lot of important things you need to consider such as getting the timing right, committing to yet another 5-year MOP, your total debt servicing ratio (TDSR) / mortgage servicing ratio (MSR) / loan-to-value ratio (LTV), resale levy and so on.

You also need to recognise that you won’t be getting as many privileges as you did when you were a first-timer.

If you’re worried about selling your current HDB BTO flat and living on the streets (or with your in-laws) for 5 years or more while your new BTO flat is being built, don’t worry. You can BTO again without selling your current flat.

However, you will need to juggle two homes, worry about your maximum loan amount, and if your TDSR and MSR are enough for a second HDB BTO. When you finally collect the keys, you will also need to sell your current flat within six months (you can try your luck with an appeal though).

Resale levy, what’s that?

There’s also the resale levy, in place to ensure that there is a fair allocation of public housing subsidies between first-timers and second-timers by reducing the subsidy enjoyed for your second HDB or EC, says HDB. For a 4-room HDB flat, you are looking at $40,000.

Am I losing out?

Like I mentioned earlier, you must be prepared to accept that you won’t have it as good as you did when you were a first-time BTO applicant. You only get one ballot chance this time, as compared to two chances when you were a first-timer.

Other ways you might rugi (lose out) include having to pay a higher interest rate for your second HDB loan, paying additional buyer’s stamp duty (ABSD) and having access to fewer grants.

If not, you can also buy a HDB flat from the resale market.

If you opt to buy a HDB resale flat as your next home, you won’t need to pay the resale levy. You won’t need to wait years for the flat to be built (but you may not be able to move in immediately, either), and you can have your pick of location.

However, there are other considerations that come with buying a HDB resale flat, such as the down payment, option fee (negotiable though), MOP (yes, there still is), financing options, number of years left on the lease, cash over valuation, renovation (but you can always choose to embrace the former flat owner’s design as your own) and so on.

And if you are negotiating this through an agent, there will of course be agent fees as well.

HDB resale flats also tend to be pricier than a HDB BTO… but most likely you would have turned a profit from the sale of your first HDB BTO flat.

Got more money to spare? You could also upgrade to private property.

So you want to move up the property rung and get a private property. First, you need to do your sums. After selling your current HDB BTO flat, do you have enough extra to fund your private property?

The good news is that you won’t need to pay a resale levy if you’re buying a private residential property. This is the same for DBSS flats (you will need to pay resale levy on an EC though).

Notes Hui Li: “Before the private resale market prices start trending up, it seems to be a good time to upgrade to a private property. Work out your sums well, make sure the mortgage payments are within your comfortable range, and always plan for some financial safety net for rainy days.”

She also advises those serious to embark on this journey to engage an active real estate agent who they trust to help with their property search, and to seek professional advice.

“It is a big purchase, buy something with no regrets and make sure the timeline matches after you sell and buy. Engage an agent who will be able to show you all the facts and data, also to share with you about the pros and cons of each property, and to identify any blind spots,” she adds.

After all, there is a high chance that you might need additional cash on hand (in addition to your sales proceeds). You should NEVER spend beyond your means, especially if you have a family to look after.

As Propnex Realty director Aaron Wan says, "Due to TDSR, these days as we aspire to upgrade and realise our profits, we must be aware also that to keep upgrading to bigger homes, our income should rise in tandem as well to be able to be eligible for the growing loan quantums."

Do you need cash on hand?

You’re still keen to upgrade but there’s one problem: You don’t have much cash on hand. It’s possible to use the sales proceeds from your HDB BTO flat, and assuming the sale of that went well, you would have at least $100,000 cash proceeds in addition to the returned CPF in your Ordinary Account (OA).

You could probably get a decent private property that’s about $1 million (or more, depending on your cash proceeds).

FOMO? Here Are The Top 10 Most Popular Condos of August 2020

Read more here.

Nevertheless, it’s still a costly purchase, what with other fees to pay such as the monthly maintenance fees, your private home insurance policy (if you were previously on the HDB Home Protection Scheme), and even higher utility bills.

So it’s wise to have rainy day funds, and extra money in your CPF OA won’t hurt to lower your overall loan amount. If you thought servicing your $500,000 HDB BTO home loan was painful, paying a monthly mortgage on a $1.5 million property is crazy — you’re looking at over $4,200 per month even at a low rate of 1.3% p.a. (that’s $2k each if you’re a couple, about half the take-home pay of most Singaporeans).

Not selling? You can move out and rent out the HDB flat

The HDB flat makes for a good retirement nest egg, so it’s understandable why many prefer to hold on to it. And after MOP, you have the option to move out and rent out the entire HDB flat for income.

You may have your reasons for doing so. Perhaps you want to go back to your parents’ or in-laws’ place because it’s nearer to your kids’ schools, or you/your spouse plans to take up a job offer overseas. Maybe you bought a private property like we mentioned above but you’re retaining your HDB flat (and need to make rental income to cover the cost of your $4.2k/month mortgage payments).

There are a bunch of terms and conditions that you can familiarise yourself with on the HDB webpage, such as who you can rent out to. Woe betide you if you decide to flout the MOP rule.

Okay, suppose you have yet to get your second property. Earlier we mentioned that you will be getting a lower LTV, so depending on how much your HDB BTO cost, your loan limit might not be able to cover enough of your future condo.

The government also tightened LTV limits by 5% in July 2018, so this means a bigger down payment in cash/CPF for you. Don’t forget LTV’s other best friends — MSR, TDSR and ABSD. For someone like me, moving back in with my mum is the best (free) route.

No pressure, it’s totally up to you

You don’t need to sell your HDB BTO flat the moment you attain MOP. In fact, you don’t even need to sell at all. All of that coordination, moving house, trips to the bank and to the HDB office, dealing with your renovation contractor and alerting everyone about your change of address will play out again.

I’m comfortable with my home and I love its location as it’s in the same neighbourhood as my mum, in a mature estate. I may sell it, but maybe far into the future when I retire (overseas?) or downsize to a short-lease 2-room flexi flat.

One of my friends is considering getting a second BTO or HDB resale flat that’s closer to her parents, but only after her daughter has finished her PSLE. That will be four years past her MOP, but she doesn’t want to disrupt her daughter’s studies.

And for those among us who see this as an opportunity to turn a tidy profit, Azhar has some closing words.

He says: “It has taken you 8 years to mine this pot of gold (cash proceeds of $100k or more), so why not make another pot of gold in 3 years (private property) or 9 years down the road (BTO again)?”

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Need help to finance your latest property purchase? Let the mortgage experts at PropertyGuru Finance help you find the best deals.

This article was written by Mary Wu, who hopes to share what she’s learnt from her home-buying and renovation journey with PropertyGuru readers. When she’s not writing, she’s usually baking up a storm or checking out a new cafe in town.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.