Discover your home's valuation

Monitor your property value in real-time

See neighbourhood insights

Track your mortgage

Find your home

Thinking of Selling?

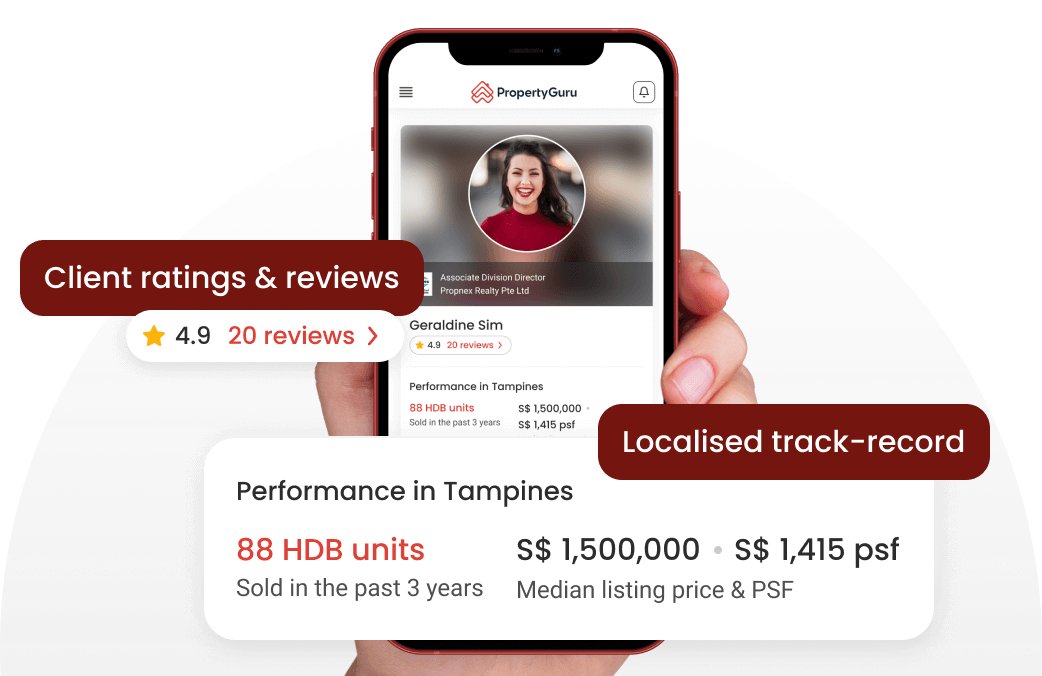

Sell with the right agent New

Discover your property's valuation and share your selling goals. Browse and connect with agents interested to help sell your home.

How home valuation works

Insights on your home, all in one place

Instant Property Valuation

Get an accurate market value for your home with our proprietary estimate. Access transaction data instantly.

Neighbourhood Insights

Stay ahead with neighbourhood insights and market trends for smart real estate decisions

Mortgage Tracking

Monitor your mortgage for timely updates on better rates and assess your savings.

Need help selling? Find agents with most transactions in your area

Ways agents can help you

Timeline planning & marketing

Connect you with ready buyers

Negotiate the best offers

Financial planning support

FAQs About Proxy Price

ProxyPrice is an estimate of the market value of the property. It is generated by PropertyGuru's state-of-the-art algorithm that calculates these values based on multiple factors such as location, size, age, condition, proximity to amenities such as schools and transportation, and market demand.

We're working on it! At the moment, you can only track 1 property at a time. Edit your property details to track another property.

Whenever you decide to sell or rent your property, PropertyGuru can help you find agents who best fit your needs. Find agents with most transactions in your area here

Great news! Mortgage tracking and additional insights have been launched and are now available to you. Enjoy exploring these new features!

General FAQs About Home Valuation

Home valuation is the process of determining the current market value of a property based on various factors, including location, condition, and comparable sales.

It helps homeowners set a competitive selling price, assists buyers in making informed decisions, and is essential for mortgage applications and refinancing.

Valuation is typically conducted by a certified appraiser who considers factors like property size, condition, location, and recent sales of similar properties.

Key factors include the property's location, size, age, condition, local market trends, and any upgrades or renovations.

It's advisable to get a home valuation every few years or when there are significant changes in the market or your property.

FAQs on HDB Valuation

HDB valuation considers specific criteria set by the Housing & Development Board (HDB) and is influenced by resale prices of comparable HDB units in the area.

The process involves submitting a valuation request to HDB, which then assigns a valuer to assess the property based on market trends and comparable transactions.

Typically, HDB valuations take about 5 to 10 working days to complete.

Yes, if you believe the valuation is too low, you can appeal by providing evidence of higher comparable sales in the area.

Yes, a formal valuation is required to determine the selling price and ensure compliance with HDB regulations.

FAQs on Condo Valuation

Factors include location, amenities, age of the building, unit size, and recent sales of similar condos in the area.

Look for certified appraisers with experience in valuing condos in your area, and check reviews or ask for recommendations.

Yes, lenders typically require a current valuation to determine the loan amount based on the property's market value.

Yes, quality renovations can enhance your condo's appeal and potentially increase its market value.

It's a good idea to get your condo valued every few years, especially if you're considering selling or refinancing.

Singapore Property Valuation Made Easy

Selling a property in Singapore can feel daunting, especially when property owners are unsure of how much their property is truly worth in today's market. From HDBs to condominiums and even landed properties, many property owners face the same challenge, particularly when they do not have a clear picture of the market valuation of property in their neighbourhood.

Without the right insights, setting a selling price can be a risky proposition — overly high prices may deter potential buyers, while overly low prices can cause homeowners to lose out on the financial returns they deserve. Singapore's property market is dynamic — prices fluctuate depending on location, demand, and economic factors, so getting a comprehensive Singapore property valuation is essential for making smart financial decisions.

This page offers easy-to-use tools, including a home valuation calculator to help property owners gain useful insights on their properties, keep track of neighbourhood trends, and find the best mortgage rates available.

Without the right insights, setting a selling price can be a risky proposition — overly high prices may deter potential buyers, while overly low prices can cause homeowners to lose out on the financial returns they deserve. Singapore's property market is dynamic — prices fluctuate depending on location, demand, and economic factors, so getting a comprehensive Singapore property valuation is essential for making smart financial decisions.

This page offers easy-to-use tools, including a home valuation calculator to help property owners gain useful insights on their properties, keep track of neighbourhood trends, and find the best mortgage rates available.

Knowing Your Property's Value Is Key

Selling a property can be a stressful experience, particularly for property owners who do not have a clear picture of its true market value. A lack of accurate market valuation of property often results in overpriced or undervalued homes.

In Singapore, property values vary depending on factors such as property type (e.g., HDB, condominium or landed homes), location, proximity to amenities, public transport connectivity, upcoming planned developments, and even the age of the building. As such, we sometimes see cases where older HDB flats in less central areas fetch lower prices compared to newer condominiums in the Core Central Region (CCR) or Outside Central Region (OCR).

Accurate and Instant Property Valuation

The first step in understanding your property's worth is obtaining an accurate valuation. The PropertyGuru home valuation calculator is an easy-to-use tool that helps property owners get an accurate estimate of their property's value based on real-time data.

Here's what the PropertyGuru market valuation of property tool can offer:

With an accurate market value of your home that can be accessed instantly, you can better decide when and at what price to list your home without overestimating or undervaluing the property.

Instant Estimates

Get a quick estimate of your property's market value based on recent transaction data.Real-time Market Trends

Learn how market conditions and demand in your area can impact your property's value regardless of your property type.With an accurate market value of your home that can be accessed instantly, you can better decide when and at what price to list your home without overestimating or undervaluing the property.

Neighbourhood Insights: A Deeper Understanding Of The Market

On top of knowing the market value of their property, it is also equally important for homeowners to understand the broader market dynamics in their neighbourhood. Real estate prices are highly dependent on location, so understanding the Singapore property valuation in the neighbourhood is as important as knowing the value of the individual property.

The PropertyGuru Neighbourhood Insights can help property owners to:

With PropertyGuru's Neighbourhood Insights, property owners can see how similar properties in the area are performing and ensure that they're not pricing their properties too high or too low compared to others in the vicinity.

The PropertyGuru Neighbourhood Insights can help property owners to:

Track Market Trends

Have property prices in your area been increasing or decreasing over time? Understanding how property prices have performed in the area over time can help homeowners gauge the right price for their properties.See Transaction Data

View recent transaction prices of recently sold similar properties in the area to make an informed decision on how to price your home.With PropertyGuru's Neighbourhood Insights, property owners can see how similar properties in the area are performing and ensure that they're not pricing their properties too high or too low compared to others in the vicinity.

Connect Your Property Value To Financing

Once their existing property is accurately valued and put on the market, homeowners can take the next step and consider how to finance their next home purchase.

Selling a home and buying a new one requires careful financial management. Understanding the mortgage options available is crucial for those looking to upgrade their homes or purchase a second property.

The PropertyGuru mortgage loan calculator helps property owners find the most competitive loan rates to get the best mortgage deal possible. From refinancing a current loan to applying for a new mortgage, the PropertyGuru mortgage loan calculator can help property owners conveniently do the following:

Knowing your financing options can significantly affect your buying power for your next property. Using the PropertyGuru mortgage calculator alongside the PropertyGuru home valuation calculator can help property owners determine the selling price of their current property and their budget for their next property. Let PropertyGuru help you stay on top of your financing and make your next move with greater confidence.

Selling a home and buying a new one requires careful financial management. Understanding the mortgage options available is crucial for those looking to upgrade their homes or purchase a second property.

The PropertyGuru mortgage loan calculator helps property owners find the most competitive loan rates to get the best mortgage deal possible. From refinancing a current loan to applying for a new mortgage, the PropertyGuru mortgage loan calculator can help property owners conveniently do the following:

Compare Interest Rates

Find the best interest rates available from different banks and financial institutions to secure the most competitive rates.Estimate Monthly Payments

Calculate monthly loan repayments based on different loan amounts, terms, and interest rates.Plan Your Loan Repayments

Plan your next home purchase by understanding the loan terms, repayment schedules, and budget based on your financial situation.Knowing your financing options can significantly affect your buying power for your next property. Using the PropertyGuru mortgage calculator alongside the PropertyGuru home valuation calculator can help property owners determine the selling price of their current property and their budget for their next property. Let PropertyGuru help you stay on top of your financing and make your next move with greater confidence.

Combine Property Valuation With Mortgage Insights For Smarter Decisions

The process of selling a property doesn't have to be overwhelming. By leveraging the right tools, property owners can simplify the decision-making process and ensure they make a well-informed choice. The PropertyGuru home valuation calculator and mortgage loan calculator equip property owners with everything needed to sell their property seamlessly.

Access to real-time, accurate market valuation of property and insights gives property owners an advantage in today's competitive real estate market. Whether it's selling an HDB flat, condominium, or private property, PropertyGuru's home insights can give homeowners the information required to:

By using these helpful tools in combination, homeowners can confidently price their property, track its market performance, and make informed decisions for their next move.

Access to real-time, accurate market valuation of property and insights gives property owners an advantage in today's competitive real estate market. Whether it's selling an HDB flat, condominium, or private property, PropertyGuru's home insights can give homeowners the information required to:

Price It Right

Use the PropertyGuru valuation calculator to find the most accurate estimate of your property's worth.Understand Market Trends

Stay updated on how similar properties in your neighbourhood are performing and adjust your pricing strategy accordingly.Secure The Best Mortgage Rates

Use our mortgage loan calculator to explore different loan options and find the best rates available for your next property purchase.By using these helpful tools in combination, homeowners can confidently price their property, track its market performance, and make informed decisions for their next move.

Get Professional Help To Sell Your Home With Ease

While the PropertyGuru home valuation calculator can give helpful insights into a property's value, enlisting the help of a professional property agent can take the selling process to the next level. Experienced agents hold market expertise and can provide property owners with additional support and strategies to ensure a smooth and profitable transaction.

Here's how agents can assist with your sale:

Start your property journey today by finding agents with the most transactions in your area. They can provide the expertise and support needed to sell your home quickly and at the right price.

Here's how agents can assist with your sale:

Timeline Planning & Marketing

Agents can help establish a strategic timeline for property listing, managing viewings, and closing the sale.Connecting With Ready Buyers

Agents have extensive networks and often work with pre-qualified buyers who are actively looking for properties in a specific area, significantly boosting the chances of selling quickly.Negotiating The Best Offers

Skilled agents will help clients navigate offers to secure the best price possible by negotiating with potential buyers on behalf of property owners.Financial Support Planning

Agents can also help with financial planning for the next home purchase, from advising on possible financial options to ensuring that property owners understand their budget and equity available for their next home.Start your property journey today by finding agents with the most transactions in your area. They can provide the expertise and support needed to sell your home quickly and at the right price.