Home loan refinancing involves moving your housing loan to another bank, usually for lower interest rates. Because most housing loans have a lock-in clause (which imposes a penalty for partial or full loan redemption during the stipulated period), many homeowners wait until three to four months before the end of the lock-in period to start exploring their refinancing options.

However, ever since the second package of COVID-19 property relief measures was announced, banks have seen an influx in refinance applications. Why is that so?

In addition to the above-mentioned COVID-19 property measures, let’s also look at the present interest rate trends to understand why the current environment is seeing such a spike in refinancing.

TDSR, MSR and LTV restrictions removed until 31 Dec 2020 for residential property loans

For those who are unfamiliar, here is a brief overview of what the Total Debt Servicing Ratio (TDSR), Mortgage Servicing Ratio (MSR) and Loan-to-Value ratios (LTV) are.

Total Debt Servicing Ratio (TDSR)

TDSR takes into account all your financial commitments. A borrower’s TDSR not exceed 60% of a borrower’s monthly income that goes towards repaying all monthly debt obligations. Do note, however, that if you have variable income such as bonuses, commissions or trade income, the financial institutions may apply a haircut to the income (normally 30%).

Mortgage Servicing Ratio (MSR)

MSR is capped at 30% of a borrower and/or joint borrower’s monthly income and only applies to buyers of HDB property and Executive Condominiums.

Loan-to-Value limit (LTV)

The LTV is the amount you are allowed to borrow to finance your home. An LTV limit of 90% means you can borrow up to 90% of your property value or purchase price, whichever is lower.

For HDB loans, the LTV is 90%. That means you will have to pay at least 10% as downpayment in cash and CPF. The lessee needs to come up with cash amount of S$5,000, with the balance of the 10% from CPF.

HDB loans are different from bank loans. HDB wipes out the full amount of the CPF Ordinary Account (except for an amount of up to S$20,000 which you’re allowed to retain in the CPF). The loan will comprise the remaining amount.

For bank loans, the LTV is 75% for your first loan, which means at least 25% in downpayments (at least 5% in cash, the rest can be in cash or

Usually, in order to avail a home loan, property buyers and/or owners need to satisfy the TDSR and LTV ratio (and MSR, if you’re buying HDB property). However, because of the COVID-19 economic downturn, The Monetary Authority of Singapore (MAS) previously announced a legal waiver for these three restrictions, until 31 Dec 2020. That means that the banks, if they so choose, do not have to limit the ratios to 60%, 30% and 75% respectively.

In October 2020, MAS further extended the support for individuals with property loans; those with existing property loans may apply to their respective bank or finance company to reduce their loan repayments to 60% of their monthly instalment, for to nine months (but not exceeding 31 December 2021).

That said, loans are still subject to each individual bank’s criteria, so ultimately, it is up to their discretion whether they want to waive the TDSR, MSR and/or LTV, or observe the same lending limits.

Homeowners also get a payment holiday, and can defer mortgage repayments until 31 Dec 2020

In addition to the TDSR, MSR and LTV waivers, homeowners are also allowed to defer their home loans until 31 Dec 2020. This is essentially a payment holiday, which reduces the financial burden of financing a home during this difficult period.

Homeowners with an existing mortgage (or who are getting a new one) can request to defer loan repayments until the end of the year. Depending on the banks’ policies, they can defer either the principle amount, or principle and interest amounts.

Do note, however, that interest will continue to be accrued on the principle amount over the deferment period, as the banks continue to bear the risks of lending funds to homeowners.

So while this may ease short-term cash flow, deferment ultimately results in a higher total interest cost.

After the deferment, if you want to lower your monthly repayments, you can also choose to extend the tenure of your mortgage by the period of deferment (i.e. up to 6 months).

Currently, home loans are now more affordable than ever, thanks to current low-interest environment

More homeowners are refinancing their mortgages as banks’ floating interest rate home loans are also at their lowest in recent years.

Right now, SIBOR home loan packages are very affordable, averaging 1.4% to 1.8% p.a., as opposed to 1.8% to 2.3% p.a. last year. That’s because the three-month SIBOR has dropped to around 0.56% this month, which is considered very low. For some context, SIBOR was on a steady rise from 2016 to 2019 – in fact, it reached a high of 2% during this same period last year.

With such trends, it’s no surprise that many homeowners have decided to strike while the iron’s hot. The group who would likely benefit the most are those switching from an HDB housing loan to a bank loan.

As opposed to the 1.4% to 1.8% p.a. SIBOR packages, HDB loans stand at a higher interest rate of 2.6% p.a. Although a floating rate as well (i.e. pegged to another rate), the interest rate for HDB loans has been stable for many years as it is pegged at +0.1% to the interest rate of CPF Ordinary Account, which seldom changes.

Likewise, those paying banks over 2% p.a. will also see significant savings.

How to calculate whether refinancing will save you money

If your salary or savings are affected by the COVID-19 recession, you can consider looking at your existing loans to better manage your monthly cash flow. If your home loan is currently charging you more than 2% p.a., you might be paying more than you need to, and should definitely consider refinancing.

Let’s look at two examples:

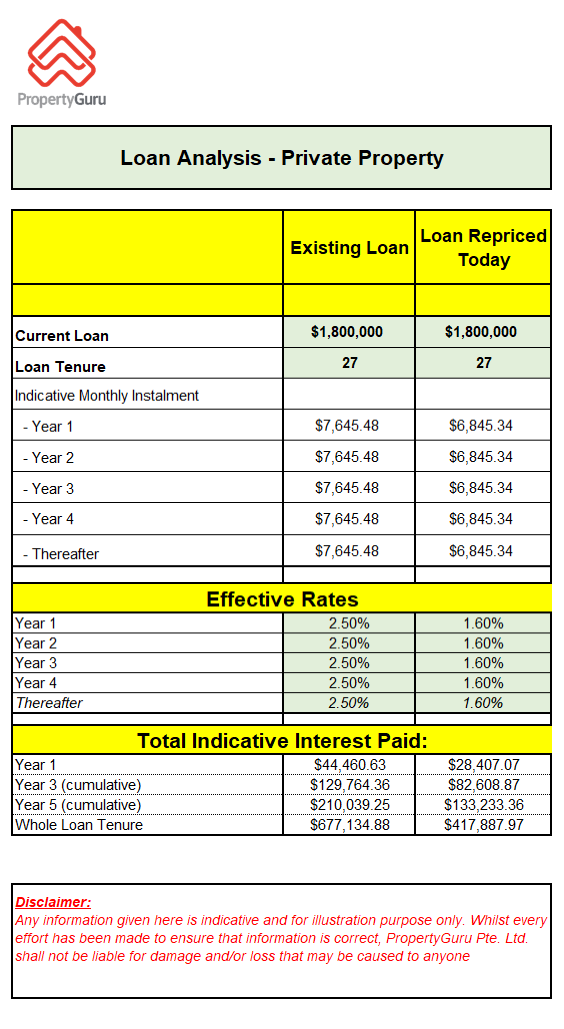

- After the 3-year lock-in period of their first private home loan, Mr and Mrs Tan have an outstanding loan amount of $ 1,800,000, for a loan tenure of 27 years, at an interest rate of 2.5%. This means they are paying $7,645.48 monthly.

After shopping around for a new home loan, the Tans found that another bank is willing to offer them an interest rate of 1.6% p.a. for 5 years. If they take it up, they will pay $6,845.34 monthly. That’s a difference of about $800 every month!

As you can see, the Tans could save about $77,000 after five years if they refinanced instead of doing nothing. The savings are more significant because they have a large outstanding loan amount ($1.8 million), but what about those with smaller loans, for say, HDB flats?

Let’s look at another example.

- The Chan family has an existing home loan of $400,000 for her HDB flat, with about 22 years left. Like the Tans, her current interest rate is 2.5%, which means she is paying $1,971.36 monthly.

If she refinances her home loan to another bank that is willing to offer her a revised home loan package at 1.5% for five years, she would pay $1,779.82 monthly instead. That’s a difference of about $192 monthly.

Other than the interest rate, factors like the lock-in periods, legal charges and valuation fees need to be taken into consideration when you refinance. These can set you back by about $2,000 to S$3,000 (depending on your property type), so it’s important to ensure that the long-term savings from your monthly repayments will cover these extra costs.

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

This article was written by Manasi Hukku. Manasi likes to cover the intersection between research and relevance to help readers find a place they’ll love. She is a UX Conversation Designer, Medium Columnist and mother of two.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.