If you’re planning to purchase your first home, you probably know how confusing things can get when you don’t have a good grasp of financial terms and jargon about housing matters. In your course of the research, you’ve likely come across the term In-Principle Approval (IPA) or Approval-in-Principle (AIP).

But what is it exactly? And is it worth the effort to get one before purchasing a home?

In short, an IPA is a communication from a bank (usually verbal or via email) detailing how much they’re ready to loan you if you purchase a home within a certain validity period. As a rough gauge, the time for approval usually takes about a week or so. There are many ways getting an IPA can help you get one step closer to your dream home. By giving you a better idea of your finances, you’ll also be better able to budget and plan for an upcoming property purchase.

How Do I Apply for an In-Principal Approval (IPA)?

The usual process of IPA application involves first sourcing for banks and comparing loan interest rates to find which one suits your situation best. Apart from being time-consuming, it can also be a source of stress for those who aren’t familiar with finance jargon and technicalities. But don’t panic just yet!

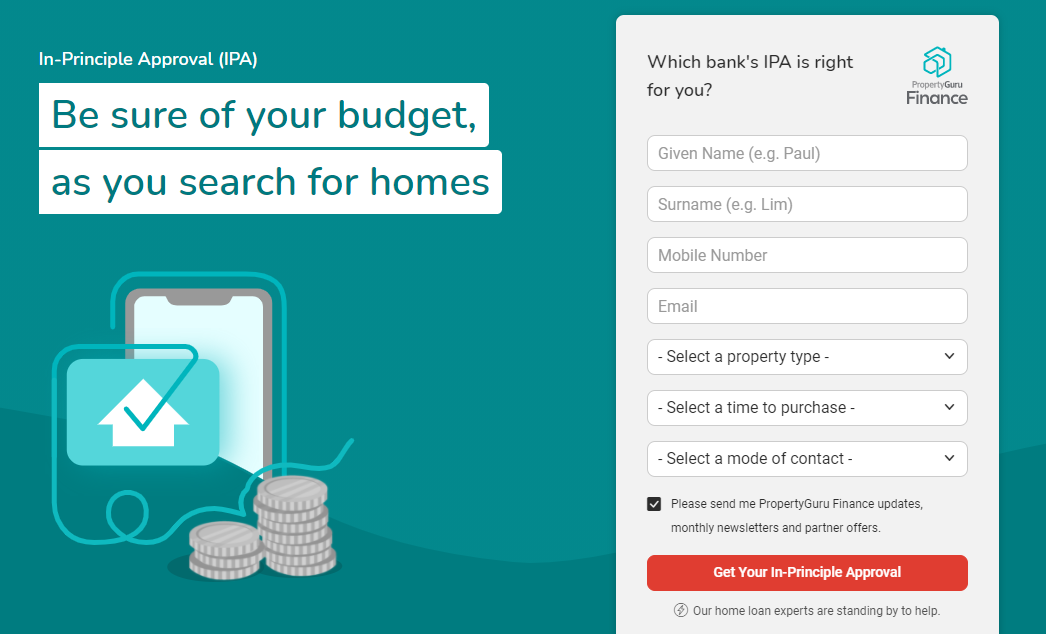

Thankfully, PropertyGuru Finance has a completely free and fuss-free IPA service to help you get started. By applying on our page, you’ll be able to get expert recommendations and advice about home loans from different banks without having to do all the heavy research yourself. Phew

Sounds too good to be true? We know. But we can assure you that it’s really as easy as it sounds. Here’s how it works:

1. Share your Details with us to Get Started

Simply visit our IPA page and let us know your contact details, along with the type of property you intend to purchase, and when you’re looking to purchase one.

2. Wait for us to Get in Touch

Once you’ve completed the necessary steps, simply sit back and wait! A home loan advisor will get back to you within the day to discuss your situation and needs. They’ll then recommend the best banks to apply with based on your purchase timeline, financial profile and loan amount required.

3. Choose Your Preferred Bank

Once you’ve decided on the bank and loan type, our advisor will then guide you through document submission and even help track the application for you. Some financial documents that are typically required for an IPA application include payslips, CPF contribution history, credit card statements, and any existing housing loans you may have.

4. Review the Results

Banks typically take about a few days to a week to get back to you on the outcome of your IPA. Once you receive it, your advisor will review the results together with you and address any concerns you may have.

Benefits of Getting an In-Principle Approval (IPA)

Sounds simple enough! But just how useful is an IPA?

Now that you’re aware of the steps involved in getting an IPA, you’re probably wondering just how useful it really is. Well, here’s how it can help you.

1. It Helps You Choose a Home You Can Afford

First and foremost, having an IPA will help you understand exactly what you can and cannot afford, assuming you’re using a bank loan to finance your home. So while that dream house of yours may be perfect in every way, it may be several thousands of dollars out of your budget.

An IPA will let you know how much a bank is willing to loan you so that you can narrow your search down to properties that fall within your financial reach while combing through listings. This is especially useful as banks assess your loan based on factors like your income, credit history and whether you and your spouse are Self Employed Persons (SEPs).

2. It Gives You a Better Gauge of Your Finances to Plan Your Downpayment Amount

As an IPA tells you exactly how much a bank is willing to loan you, you’ll be able to make the necessary calculations to ascertain if you would be able to pay the loan back within your targeted time frame. You could also use that as a gauge to decide if you wish to make a high downpayment at the start, to lower your monthly repayment amount later on.

As a note, buyers taking out a bank loan would be required to pay at least 25% of the purchase price upfront, of which up to 20% can be paid with cash and/or their CPF Ordinary Account savings, and the remaining 5% in cash.

3. It Minimises the Risk of Losing Your Option Fee

Perhaps the reason why a lot of buyers seek out an IPA is to prevent losing their Option to Purchase (OTP) fee. An OTP is a legal agreement between the buyer and seller (or developer) to purchase a property from the seller in future.

In other words, it’s a way to ‘chope’ that dream house of yours.

When signing an OTP, the buyer is required to pay an option fee to ‘reserve’ the property. So if you do back out from the agreement, you forfeit the amount paid. Typically, the OTP is something you can negotiate with the seller about. It is usually 1% for most properties and 5% for under-construction buildings (BUCs) but may be higher for unusual circumstances (for example, longer option period). For HDB resales, the fee is usually not more than $1,000. Find out more about OTP here.

Most of the time, buyers don’t back out of a property transaction because they are indecisive or change their minds. But in the event that they do, it’s usually because they later realise that they can’t actually afford the property.

As mentioned previously, having an IPA on hand allows you to gain a better understanding of your finances from the get-go so the chances of you making an offer you might later regret are slimmer. That way, you avoid losing money before you’ve even purchased a property. An IPA ‘assessment’ will also help you understand what parts of your income the financial institutions ‘recognise’.

Finally, Is There Anything Else I Should Be Mindful Of?

So as you see, despite being an ‘optional’ step in the housing purchase process, an IPA can be very useful and can inch you closer to that property you’ve been eyeing. On this note, we should also mention that should you wish to still do your research and approach banks directly, you may come across the term ‘pre-qualification’ in some of their marketing materials.

Unlike an IPA, which is a form of ‘pre-approval’, a pre-qualification is not a commitment from the bank that you will get the loan you require. It is instead, just a rough gauge of how likely you will be to get your hands on the loan you require based on various criteria. To prevent unnecessary confusion, we’d again recommend using the PropertyGuru IPA service to clarify any doubts you may have.

That said, an IPA is no doubt a great first step in getting closer and achieving that dream home you so desire.

Chat with us on WhatsApp

Fill up an online form

Chat with us on WhatsApp

Fill up an online form

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.