Data can tell us a great deal about the property market. As the largest property portal in Singapore, our aggregated listings data offers valuable insight into the property market from the sellers’ point of view. For our 2020 Property Market Outlook, we sought to uncover the growth of property value (including ‘negative growth’) for each of the 27 districts in Singapore over the past three years, or 12 quarters—a time frame long enough to reveal a trend and short enough to be relevant and current.

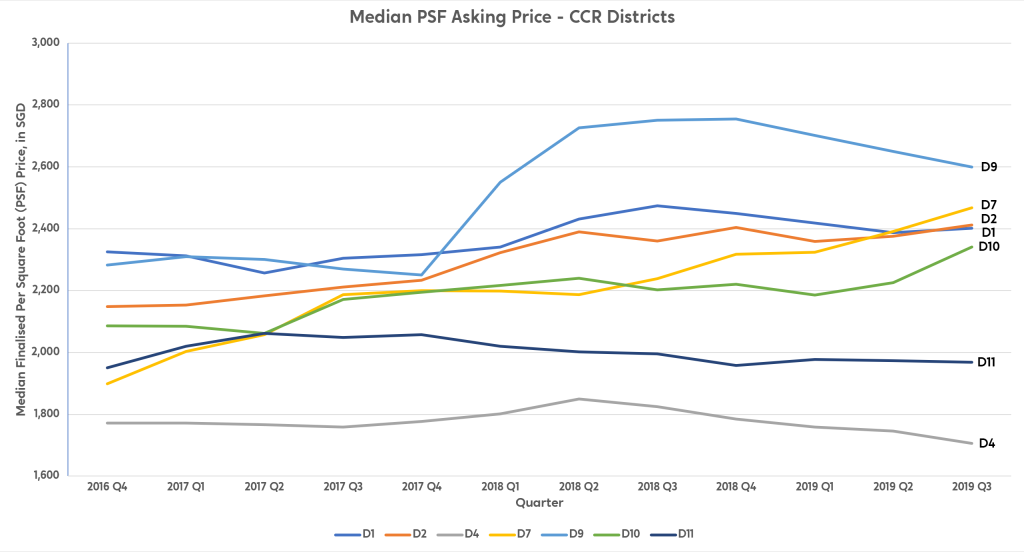

Overall, median per square foot (psf) prices in Singapore increased by 12% over the past three years. Zooming in to districts in the Core Central Region (CCR), we aggregated data on asking prices—median per square foot (psf) asking prices—for the past 12 quarters (Q4 2016 to Q3 2019). These asking prices incorporate both resale and new launch listings of non-landed private residential property in Singapore . Mapping out the results, this article reveals how seller sentiment for each CCR district has evolved.

Core Central Region (CCR) Asking Price Trend*

*District 6 is excluded due to the low number of residential projects and transaction within the district

District 1

Where: Raffles Place, Boat Quay, Marina Bay

Asking price change over three years: +3%

Q4 2016 Median psf asking price: $2,325

Q3 2019 Median psf asking price: $2,401

Q3 2019 Median psf asking price: $2,401

2019 new launch condos in District 1:

- None

Upcoming amenities: Shenton Way MRT Station (2021)

See all District 1 condos for sale on PropertyGuru

District 2

Where: Chinatown, Tanjong Pagar

Asking price change over three years: +12%

Q4 2016 Median psf asking price: $2,148

Q3 2019 Median psf asking price: $2,412

Q3 2019 Median psf asking price: $2,412

2019 new launch condos in District 2:

Upcoming amenities: Maxwell and Shenton Way MRT Station (Thomson-East Coast Line; 2021), Cantonment MRT station (Circle Line; 2025)

See all District 2 condos for sale on PropertyGuru

District 4

Where: Harbourfront, Telok Blangah, Sentosa

Asking price change over three years: -4%

Q4 2016 Median psf asking price: $1,772

Q3 2019 Median psf asking price: $1,706

Q3 2019 Median psf asking price: $1,706

2019 new launch condos in District 4:

- None

Upcoming amenities: Sentosa and Pulau Brani redevelopment, Keppel Club redevelopment, Keppel MRT Station (Circle Line; 2025)

See all District 4 condos for sale on PropertyGuru

District 7

Where: Beach Road, Bugis, Rochor

Asking price change over three years: +30% (Highest in Singapore)

Q4 2016 Median psf asking price: $1,898

Q3 2019 Median psf asking price: $2,467

Q3 2019 Median psf asking price: $2,467

2019 new launch condos in District 7:

Upcoming amenities: Guoco Midtown mixed-use development (2023), Rochor Centre redevelopment (TBC), North South Corridor expressway (2026)

See all District 7 condos for sale on PropertyGuru

District 9

Where: Orchard and River Valley

Asking price change over three years: +14%

Q4 2016 Median psf asking price: $2,282

Q3 2019 Median psf asking price: $2,600

Q3 2019 Median psf asking price: $2,600

2019 new launch condos in District 9:

Upcoming amenities: Great World and Orchard MRT interchange (Thomson-East Coast Line; 2021)

See all District 9 condos for sale on PropertyGuru

RECOMMENDED ARTICLE: This new D9 luxury condo has only ONE unit type

District 10

Where: Tanglin, Holland, Bukit Timah

Asking price change over three years: +12%

Q4 2016 Median psf asking price: $2,086

Q3 2019 Median psf asking price: $2,341

Q3 2019 Median psf asking price: $2,341

2019 new launch condos in District 10:

- Wilshire Residences

- Fourth Avenue Residences

- RoyalGreen

- One Holland Village Residences

- Juniper Hill

- The Hyde

- One Draycott

- Boulevard 88

- Cuscaden Reserve

- Jervois Treasures

- Jervois Privé

Upcoming amenities: One Holland Village mixed-use development, Orchard Boulevard and Napier MRT station (Thomson-East Coast Line; 2021)

See all District 10 condos for sale on PropertyGuru

District 11

Where: Newton and Novena

Asking price change over three years: +1%

Q4 2016 Median psf asking price: $1,951

Q3 2019 Median psf asking price: $1,968

Q3 2019 Median psf asking price: $1,968

2019 new launch condos in District 11:

Upcoming amenities: HealthCity Novena (by 2030)

See all District 11 condos for sale on PropertyGuru

Want more insight into trends? Check out the PropertyGuru Market Outlook 2020 now

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.