So, it’s been a while since you bought your first property and took a mortgage to finance the purchase. Perhaps, it’s now an opportune time to take a hard look at your home loan.

For those who are taking a floating home loan, you’ve probably noticed your monthly mortgage amounts steadily rising over the past year. That’s why in the current high interest rate environment, it’s more prudent than ever to take an active hand in managing your home financing decisions.

Whether it’s switching from a SIBOR-pegged to a SORA-pegged home loan or choosing a more competitive mortgage package, repricing or refinancing can help you to save some cash and bring down your mortgage payments by a few hundred dollars.

So, if you know the lock-in period of your existing home loan is almost over, or are unhappy with your current interest rates, it’s a good time to check in on your mortgage health. Confused about the best route to take to the land of savings? Let us help.

Watch Our Video on Refinancing

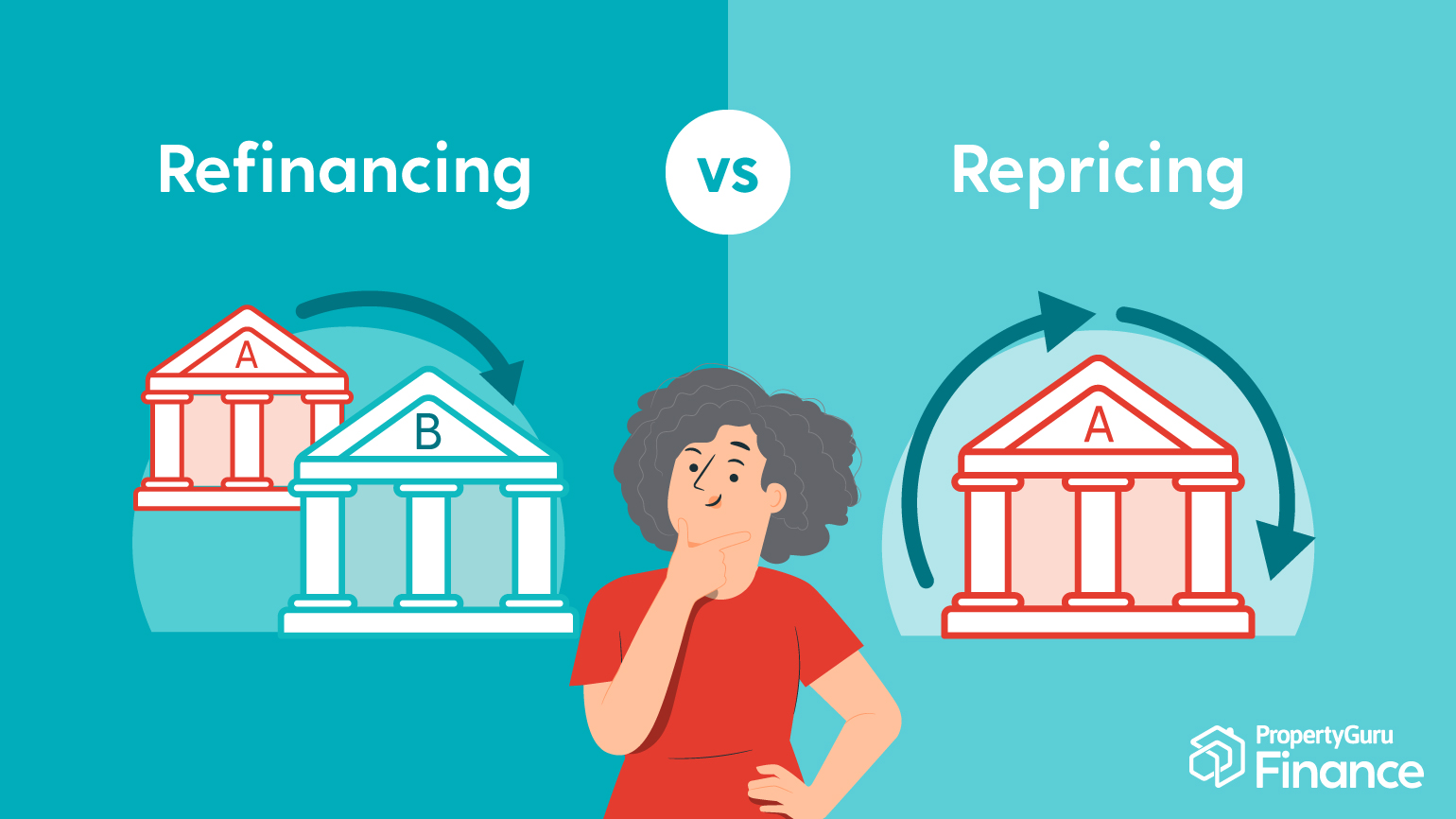

Refinancing Vs Repricing: What Is the Difference?

Typically, for a bank loan, a lower interest rate is offered until the lock-in period is over. However, the amount of interest paid tends to increase after the lock-in period is over.

By refinancing or repricing, you can potentially avoid missing out on savings or paying unnecessary excesses when you switch to a more competitive interest rate. But which process is best for you?

In a nutshell, here are the pros and cons of refinancing versus refinancing your home loan:

So, Should You Choose Refinancing or Repricing?

But Will a Mortgage Broker or Banker Help Me Best?

Once you resolve the route to take, who do you go to for the best, unbiased advice: a banker or a broker? This is a tough one – we hear you!

To learn a little more about the two and determine who would best serve your needs, we have roped in PropertyGuru Finance Mortgage Experts Kendrick Quek, Ethan Ng, and Apple Tan to lend their input.

Straight off, our experts are quick to clarify that regardless of whether you choose a mortgage broker or banker, both have a vested interest in building customer relationships and up-to-date knowledge of the products offered by the various banks in Singapore.

However, mortgage brokers are specialists and focus on building customer relationships for the long-term benefit of both parties. As Ethan Ng, Team Lead, Mortgages, puts it, “It’s a lifetime commitment to our clients. We provide advice when our clients reach different milestones – whether it be purchasing a new home, refinancing, or decoupling. Mortgage brokers are a one-stop service. We provide unbiased views about finding and financing a home."

And unless you have your sights fixed on one lender, mortgage bankers usually are the ones who can best assist you. Kendrick Quek, Sales System & Process Manager, mentions that bankers are “obligated to sell customers their own bank’s products”, and are unable to compare loans with other banks thoroughly.

Here’s a quick summary of the difference between a mortgage broker and banker:

Now we know the difference between a mortgage banker and broker. But what’s the difference between going for a mortgage broker and a Mortgage Expert from PropertyGuru Finance?

When you’re choosing PropertyGuru Finance, you’re choosing more than a broker. We won’t just provide you access to the best interest rates across all major banks and give you unbiased advice. We’ll also monitor your mortgage for the long term and provide you with bespoke home loan strategies so that you never miss the next best moment to save more.

Let PropertyGuru Finance Help You Plan Your Loan

It’s easy to feel overwhelmed when figuring out these home loan processes due to unfamiliarity with the paperwork, tedious procedures and the time-consuming nature of comparing bank loans.

If you decide to go with a mortgage broker for help, rest assured that you’ll be in good hands with the Mortgage Experts at PropertyGuru Finance. But if you’re still undecided, PropertyGuru Finance also offers a whole suite of services and useful tools to help you go along.

You can:

- Figure out the best time to refinance your loan so that you can save more on your home loan with SmartRefi.

- Budget better by working out your monthly repayment amount with the mortgage repayment calculator.

- Obtain an In-Principle Approval (IPA) to ensure that you can attain your ideal home loan with our IPA service.

- Search for the perfect home loan and compare competitive rates easily with our free-to-use mortgage loan comparison tool and refinancing comparison tool.

- Better estimate your loan eligibility with the PropertyGuru Finance mortgage affordability calculator.

Mortgage Comparison Tool

Find the best loans and interest rates from major banks

Affordability Calculator

Estimate what you can comfortably spend on your new home

Learn more about our SmartRefi tool here.

As Apple, Team Lead, Mortgages for PropertyGuru Finance, cheekily puts it, “We’re here to make loan financing smart, effortless and transparent. Most importantly, we’re here to save you time and money!”

If you’re still unsure of whether to go for refinancing or repricing or need help with paperwork and legal processes, you can always ask our friendly Mortgage Experts. Aside from demystifying and simplifying the refinancing process, these experts can give you tailored home financing advice – all for free!

Whatever you pick, do factor in the incidental costs and ensure your choice makes financial sense to you.

Chat with us on WhatsApp

Fill up an online form

Chat with us on WhatsApp

Fill up an online form

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.