The PropertyGuru Singapore Property Market Index Q2 2020 looks over the key property data points that rounded out in Q1 2020 and illustrates the trends that may unfold as we enter Q2 2020.

In our report, we assess the impact of COVID-19 and the circuit breaker in Singapore. Interestingly, despite the economic impacts of both, growth can be still found in a few districts.

This report elaborates on the aforementioned trends in further detail, with the spotlight shining on the best and worst-performing districts. Furthermore, it will highlight the new launches that are likely to continue to outperform the general market due to their exceptional attributes.

Key highlights of the PropertyGuru Property Market Index Q2 2020 report:

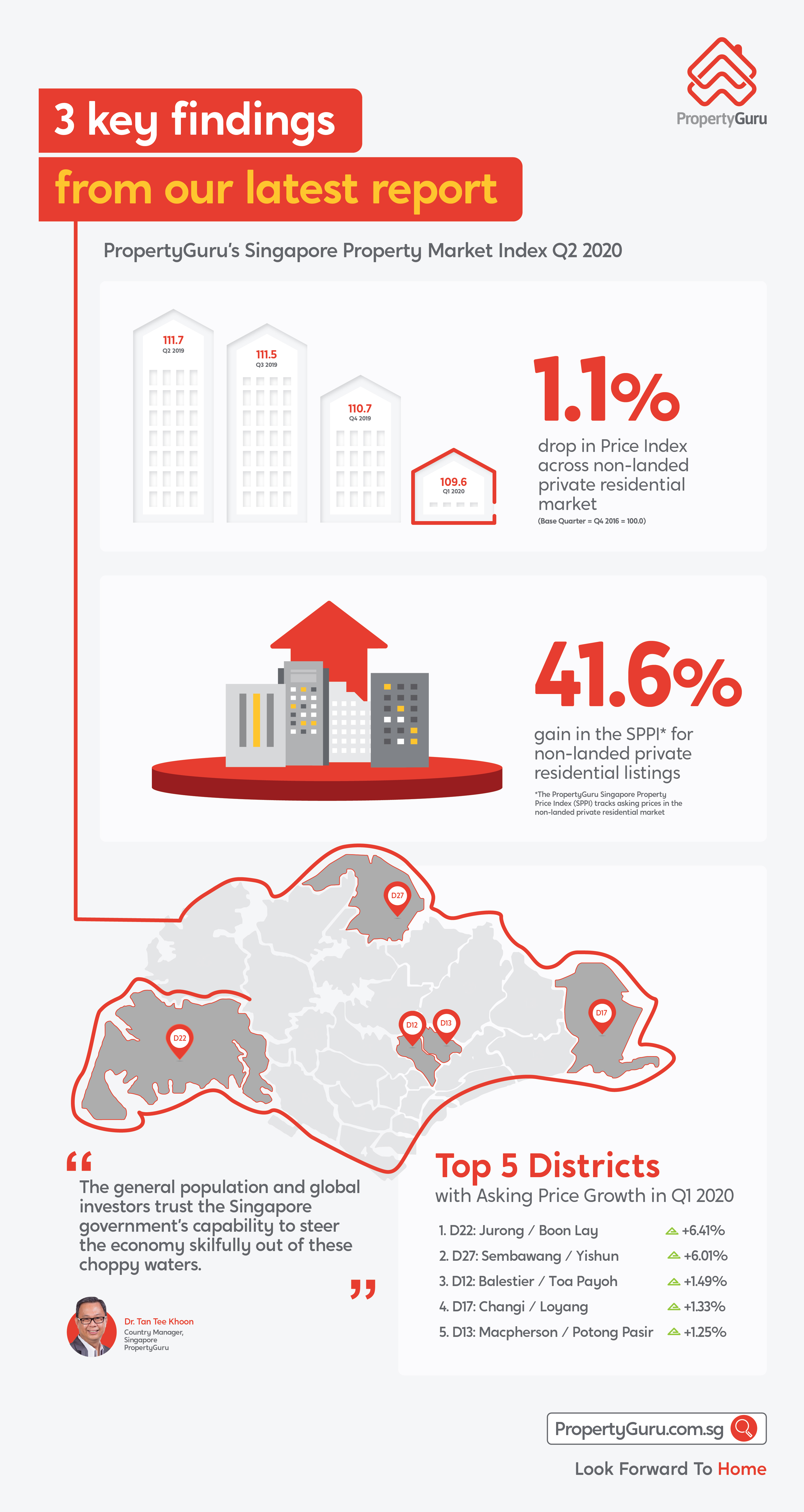

- Asking prices in the non-landed private residential sector continue to see softening as prices trend downward for a third successive quarter. The significantly higher number of listings found on PropertyGuru this quarter signals higher downside price pressure and is likely to continue for another quarter, as Q2 2020 bears the brunt of at least two months of circuit breakers.

- Six of the top ten best-selling uncompleted condominiums in the quarter were launched prior to 2019. Developments within a leisurely 10-minute walk to MRT stations continue to be in high demand, with six out of 10 projects embodying this attribute.

- Buyers preference for larger-scale developments can also be observed as seven out of 10 projects exceed a thousand units per development. Moving forward, developers are likely to have an increased risk tolerance for larger plots of land as it is proven that demand is healthy and present.

- The top five performing districts from the first quarter are made up of 3 Outside Central Region (OCR) and 2 Rest of Central Region (RCR) districts, while the bottom 5 performing districts consist of 3 from the Core Central Region (CCR) and 2 from the Outside Central Region (OCR) district. This is in line with historical trends of the Asian and Global Financial Crisis where the Core Central Region (CCR) districts typically contracted the most.

Download the full PDF report here: PropertyGuru Property Market Index Q2 2020 report

With special thanks to Stuart Chng for his contributions to the Singapore Property Market Index Q2, 2020

Stuart is the Senior Associate Executive Director of OrangeTee & Tie, is a renowned leader in the real estate industry and co-founder of Navis Living Group.

Having been a licensed real estate agent for 14 years, he is also an investor, speaker and columnist for several real estate media and blogs. Stuart has helped many clients grow their wealth through selecting great property investments and managing their portfolios actively.

Find out more about him at www.StuartChng.com/blog

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Need help financing your latest property purchase? Let the mortgage experts at PropertyGuru Finance help you find the best deals.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.