Coming from the back of a solid 2019 where over 10,000 new home sales were recorded, coupled with low interest and unemployment rates, it all seemed like the stars were aligned to make 2020 another defining year for properties.

But then the COVID-19 epidemic happened.

Taking the world by storm, the virus landed on Singapore shores in early February. Soon after, it broke out within the community.

At first, it was business as usual as the property market seemed to be unperturbed by the virus. But little by little, the virus began to jeopardise the economy and the real estate sector. Then came the circuit breaker measures, which effectively banned public gatherings, including those at showflats.

"With increasing COVID-19 cases and preventative measures, such as the ‘circuit breaker’ being implemented by the government, the preceding 2 months turned market sentiments and all previous market forecasts on their head," said Tan Tee Khoon, Country – Manager, PropertyGuru Singapore.

"The quarter-on-quarter (QoQ) downtrend in median per square feet (pdf) asking prices can be attributed to deterioration of market sentiments due to the worsening of COVID-19, but interestingly, amidst this challenging period, growth can still be found among a few districts."

What is the PropertyGuru Property Market Index report?

Buying a home is likely one of the most expensive decisions we’ll make, and that’s why it’s important to have the relevant and sufficient information to make confident property decisions.

As a leader in the real estate market in Singapore, PropertyGuru processes a vast amount of real estate data daily, providing you with the necessary data to crunch, and deliver in-depth insights to all Singaporean home seekers.

PropertyGuru piles all the data together into a report known as the PropertyGuru Property Market Index (PMI). Our report piles data from over 200,000 private home listings on PropertyGuru every quarter and compares the average asking prices for non-landed private residential properties (also known as the PropertyGuru Singapore Property Price Index, or abbreviated as SPPI) and the number of non-landed private residential listings (also known as the PropertyGuru Singapore Property Supply Index, or SPSI).

A recap of the Q1 2020 report

The Property Market Index Q1 2020 report showed that asking prices for non-landed private residential properties continued to fall for the second successive quarter, which could be attributed to an increase activity on the part of sellers in the condominium resale market.

On the other hand, there was an increase of property listings on PropertyGuru, which implied that more owners were willing to sell.

In terms of psf growth and moderation among districts, districts 11, 23, 22, 26 and 25 had the highest price psf growth, whilst districts 7, 9, 1, 17 and 27 saw the highest price moderation, highlighting districts 11, 26 and 14 as the districts to look out for.

Meanwhile, the report also said that further downward pressure in prices was likely, as the huge number of unsold units from developers could cause prices of older homes to stagnate. Furthermore, investors were also looking to cash-out their assets after the lapse of their three-year Seller Stamp Duty (SSD).

“There could be investors out there who look at the current market and feel that the value of their properties will not appreciate as much as it did over the past few years, and may consider

liquidating their assets,” said Tee Khoon.

liquidating their assets,” said Tee Khoon.

What the Q2 2020 report reveals

Asking prices continue to slump; more listings on PropertyGuru

For a third successive quarter, The PropertyGuru Singapore Property Price Index (SPPI), showed that asking prices in the non-landed private residential sector continue to fall, falling by 1.1% to 109.6.

Meanwhile, listings on PropertyGuru continued to increase quarter-on-quarter (QoQ); increasing by 41.6% to 136.2. It was also the third successive quarter increase.

The QoQ downtrend in median psf asking prices reflects a deterioration of market sentiments due to COVID-19, the worsening situation globally and the economic impact of the circuit breaker in

Singapore. Interestingly, amidst these challenging times, growth can be found in a few districts.

Singapore. Interestingly, amidst these challenging times, growth can be found in a few districts.

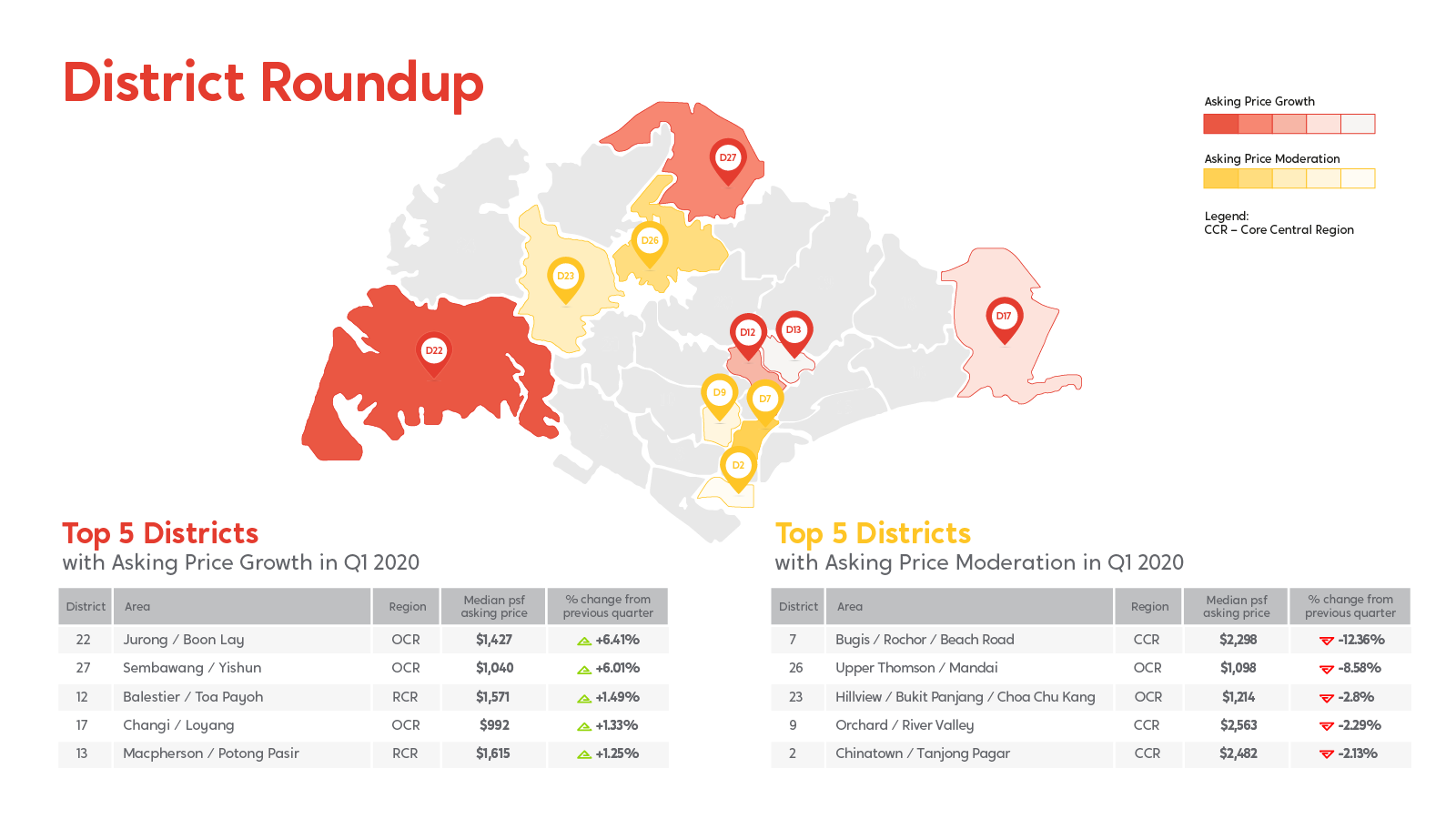

Top 5 districts with the highest asking price growth in Q1 2020

22

Jurong / Boon Lay

OCR

$1,427

6.41% increase

27

Sembawang / Yishun

OCR

$1,040

6.01% increase

12

Balestier / Toa Payoh

RCR

$1,571

1.49% increase

17

Changi / Loyang

OCR

$992

1.33% increase

13

Macpherson / Potong Pasir

RCR

$1,615

1.25% increase

Top 5 districts with asking price moderation in Q1 2020

7

Bugis / Rochor / Beach Road

CCR

$2,298

12.36% decrease

26

Upper Thomson / Mandai

OCR

$1,098

8.58% decrease

23

Hillview / Bukit Panjang / Choa Chu Kang

OCR

$1,214

2.8% decrease

9

Orchard / River Valley

CCR

$2,563

2.29% decrease

2

Chinatown / Tanjong Pagar

CCR

$2,482

2.13% decrease

3 districts to watch in Q2 2020

#1. District 9 (Orchard / River Valley)

| QoQ Supply Index change | +42.6% |

| QoQ median psf asking price change | -2.3% |

| Median psf asking price | $2,563 |

The Guru View: Recent launches in Q1 2020 such as Kopar at Newton and The Avenir have seen a healthy take up rate with the former in particular, launching near to the circuit breaker commencement and still performing at a healthy sell-through rate. This can be attributed to the reasonable price that developer, CEL Development, had decided to launch at.

The resulting PropertyGuru Supply Index increased from 106.7 to 139.3 or a jump of 42.6%. With District 9 being the evergreen crown jewel of Singapore, and the likelihood of increasingly attractive deals surfacing soon, we can expect buyers to return enthusiastically if the situation improves

during H2 2020.

during H2 2020.

#2. District 21 (Clementi / Upper Bukit Timah)

| QoQ Supply Index change | +23.7% |

| QoQ median psf asking price change | -0.2% |

| Median psf asking price | $1,641 |

The Guru View: Prices in District 21, consisting of Upper Bukit Timah, Clementi Park and Ulu Pandan, declined a marginal 0.2% QoQ, whilst the PropertyGuru Supply Index increased by 23.7%.

Listings count increased in the last quarter while prices corrected from $1644 psf to $1641 pdf. The marginal price decline can be attributed to the popularity of this neighbourhood with its numerous highly regarded schools, accessibility to town and suburban amenities, along with the gazetted 2019 URA Masterplan to develop this neighbourhood. Exciting plans from an integrated transportation hub at Beauty World, conservation and greening efforts to develop the area should inject renewed vibrancy into this highly sought after neighbourhood.

#3. District 23 (Dairy Farm / Bukit Panjang / Choa Chu Kang)

| QoQ Supply Index change | +54% |

| QoQ median psf asking price change | -2.8% |

| Median psf asking price | $1,214 |

Guru View: Prices in District 23 declined by 2.8% with median asking prices reaching $1214

psf. The PropertyGuru Supply Index for District 21 highlighted a 54% increase QoQ. The price decline can be attributed to the new supply from ‘Mont Botanik’, ‘Dairy Farm Residences’ and ‘Midwood’, on top of remaining units that came onto market from ‘Le Quest’ which achieved its

TOP in March 2020.

psf. The PropertyGuru Supply Index for District 21 highlighted a 54% increase QoQ. The price decline can be attributed to the new supply from ‘Mont Botanik’, ‘Dairy Farm Residences’ and ‘Midwood’, on top of remaining units that came onto market from ‘Le Quest’ which achieved its

TOP in March 2020.

However, PropertyGuru notes that with almost 4,900 HDB flat owners in Choa Chu Kang and Bukit Panjang reaching their MOP in 2020, and another 2,500 owners in 2021, it is likely that the sell-through rate of private homes in District 23 will increase substantially if circuit breaker eases by Q3 2020.

Want to read the full report? Download the PDF version here.

With special thanks to Stuart Chng for his contributions to the Singapore Property Market Index Q2, 2020

Stuart is the Senior Associate Executive Director of OrangeTee & Tie, is a renowned leader in the real estate industry and co-founder of Navis Living Group.

Having been a licensed real estate agent for 14 years, he is also an investor, speaker and columnist for several real estate media and blogs. Stuart has helped many clients grow their wealth through selecting great property investments and managing their portfolios actively.

Find out more about him at www.StuartChng.com/blog

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Need help financing your latest property purchase? Let the mortgage experts at PropertyGuru Finance help you find the best deals.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.