Are you servicing a mortgage at the moment? Do you feel like you could get a better deal and save on some interest payments at this time if you refinance your home loan? If you do, you aren’t alone. After all, bank mortgage rates are currently very competitive.

If you can find a good deal that suits your financial situation, refinancing your bank mortgage is a great way to reduce how much you pay on your home loan. But before you take the plunge, it’s important to understand whether refinancing actually makes sense for your situation, and how much you can actually save.

In this guide, we’ll show you how to calculate your savings, and what factors to consider that could impact how much you can save.

Refinancing Case Study

To illustrate the above, we’ll be using a common scenario as our refinancing case study:

- Name: Mr and Mrs Abdullah

- Property: A $300,000 resale flat

- Current mortgage: Pegged to the board rate, hovering at 1.8% to 2%

- Time that mortgage has been serviced: 4 years

- Payments made: Initial downpayment of $75,000, repayments amounting to $45,000 so far

- Principal Remaining: $225,000

Mr and Mrs Abdullah want to explore refinancing because interest rates have fallen low in these months, and they want to take advantage of it to find a better deal that offers them more savings than their current loan. Their previous home loan package period has ended, and right now, they are paying a hefty 1.8% to 2% (pegged to the bank’s board rate).

The mortgage they intend to refinance to is a 3M SIBOR+0.9% floating-rate mortgage from a bank. Say the 3M SIBOR is about 0.4, which is where the rate is hovering currently, the interest rate would be 1.3%.

How Much Can Be Saved from Refinancing?

For Mr and Mrs Abdullah to decide whether this mortgage is a good option for them to refinance, the most basic thing they need to do is to calculate how much they stand to save in interest payments, and monthly repayments.

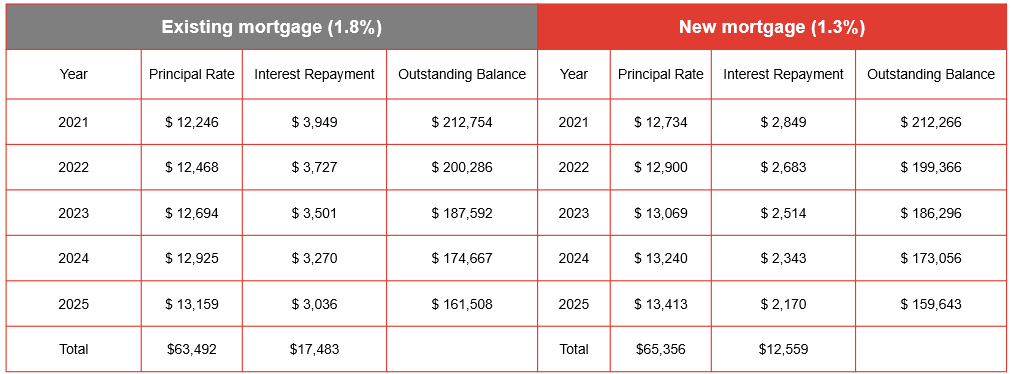

In their case, the Abdullahs do not intend to change their remaining loan tenure. Basing off a 16-year loan tenure, they can use an online mortgage calculator to project how much they might pay each year.

As their target mortgage has a floating rate, the interest may change from time to time, but given the current low levels for benchmark rates in general, the Abdullahs are assuming that the 1.3% is reliable enough as an average gauge for the next 5 years or so—or that it may even decrease.

If the Abdullahs do not refinance, they will continue paying at least $1,350 per month (based on 1.8%). If they refinance and assuming the interest rate applied is 1.3%, they will pay $1,299 per month instead.

That’s savings of over 3% monthly!

If we look in the longer term, the annual payments for the next five years for the Abdullahs would look something like this…

The Abdullahs can expect to save about $5,000 in the next five years, assuming that the current 1.3% rate they have on the mortgage does not adjust any higher.

However, with floating rates, there will always be some element of uncertainty as to exactly how much one might save, and the Abdullahs will have to keep monitoring their mortgage in the years moving forward, to ensure they get the most value out of it, or to refinance again when they no longer feel at an advantage.

Having projected their interest rate savings, however, Mr and Mrs Abdullah’s jobs aren’t done yet. They can’t just go out and refinance based on this calculation, because there are still other factors that may lead to costs that erode what they may save on this new loan.

Considering Refinancing Costs

The biggest cost factor that the Abdullahs will have to consider in their calculations will be the cost of refinancing the loan in the first place. Refinancing costs, which comprise legal and valuation costs, as well as any other applicable bank fees and charges, can be as much as $3,000 or more.

Take for example that the Abdullahs’ mortgage would cost them about $2,800 in refinancing fees. For the next five years, this would more than halve the amount they could save, though they would still save over $2,000, and may continue to save in the further years if the interest rate remains below the original mortgage’s 1.8%.

The question that the Abdullahs—and everyone considering refinancing—must answer for themselves is, how little is too little? This will differ depending on your risk appetite, your financial situation, and what other benefits you may be getting from your package.

Refinancing Subsidies and Clawback Period

After finding out about the refinancing costs, Mr and Mrs Abdullah were discouraged as they felt the remaining amount of savings for the near future was a bit too little to warrant the effort and cost of refinancing. However, there was one thing they had forgotten: their bank also happens to offer a legal cost subsidy of $2,000 as long as they do not refinance for three years.

This changes everything again, because it means that their refinancing would only effectively cost them $800, allowing them to still save over $4,000 on their mortgage interest in the next few years. Given that the Abdullahs have no plans to refinance again in the next few years, they feel this subsidy is a bonus with no catches for them.

Banks often partially or fully subsidise legal and other fees to entice mortgage holders to refinance with them, on condition that they respect a clawback period within which the borrower must pay back the subsidy if he chooses to refinance.

If you intend to refinance often, and even within the clawback period, to take advantage of better deals in the market, then you will not be able to factor in the subsidy as savings in your own mortgage calculations. However, if you take a more measured pace (say, refinancing once every five years or more), then the subsidies could be an important factor in getting value out of refinancing.

Don’t Forget The Lock-in Period

In addition to subsidy clawbacks, another potential cost for those planning to refinance their bank mortgage would be potential bank penalties if they refinance within the lock-in period.

To most borrowers, this will not matter—and it certainly wouldn’t matter to the Abdullahs, who do not intend to refinance so soon again. However, the future is never certain, and even if lock-in costs don’t factor into your calculations now, you should keep them in mind should the situation suddenly arise due to the market situation or your own financial situation changing.

Is It Worth To Refinance Your Home Loan?

Whether or not refinancing is worth your while is ultimately decided by you, but we hope that the above guide was useful in helping you to work out your potential savings.

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.