For many savvy homeowners, the process of refinancing their home loan is a given, especially when there are lower interest rates available in the market. If you are already getting the lowest rate, there probably isn’t much more you can do to save on your mortgage, right?

Think again! There is actually more that you can do to reduce your total interest costs.

Mortgage rates in Singapore are amongst the lowest in the world with rates remaining well below 2%. Here is our top (and certainly most under-utilised) strategy when it comes to lowering home loan rates.

Make a Lump Sum Prepayment to save on Interest in the Long-run

This might seem obvious, but this is a strategy that many are unaware of.

Let’s take a closer look at how different lump sum prepayment amounts affect interest rates.

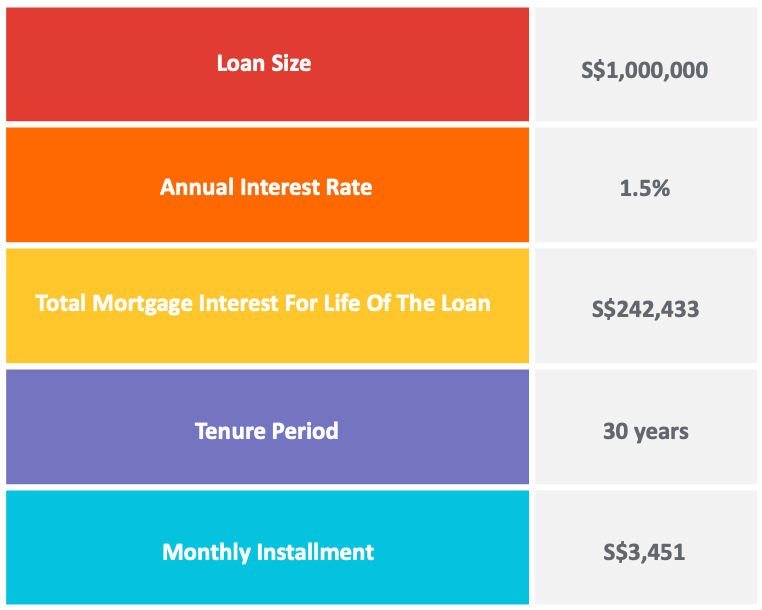

Meet Paul, a 35 year old Singaporean who has been viewing different properties with the goal of moving into a home this year. Let’s assume Paul has taken a loan of S$1,000,000 for the purchase of this property.

Here’s how the numbers for Paul’s mortgage will look:

Scenario 1

After servicing his loan for a year, Paul decides to contribute $100,000 towards reducing the outstanding loan. Here is how much Paul will save on interest charges.

Did you know you can further increase your savings on your mortgage? Here’s how!

Scenario 2

After the lump-sum prepayment, the bank will adjust your monthly installment based on the remaining loan tenure (in Paul’s case, 29 years).

Banks, however, normally allow clients to maintain their original installment amount. This, in turn, reduces the loan tenure. In this case, if Paul continues to keep his monthly installment at S$3,451. The loan period will be reduced from 29 years to 25 years!

These methods are just the tip of the iceberg. Imagine how much more Paul could save if:

With these 2 simple moves, Paul is able to save a total of S$65,228 in interest, or 27%!

With these 2 simple moves, Paul is able to save a total of S$65,228 in interest, or 27%!

- He contributed an amount higher than the S$100,000 used in this example

- He makes regular partial repayments going forward; and

- He manages to refinance his loan for more favourable interest rates.

There are attractive home finance packages available currently, and now is an opportune time to re-evaluate your current home loan.

Do note that within the terms and conditions of the mortgage agreement, there is usually a clause which explains that the remaining of the principle which would be recalculated over the remaining tenure of the loan. Most banks allow their customers to hold the monthly instalments constant.

For more property news, content and resources, check out PropertyGuru’s guides section.

Looking for a new home? Head to PropertyGuru to browse the top properties for sale in Singapore.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.