Singaporeans are more positive about the property market, according to the latest findings in the Consumer Sentiment Study for H1 2020.

The Sentiment Index has increased 5 points from 40 to 45, indicating a positive uptick in sentiment amongst Singaporeans on the local property market. The higher satisfaction level is largely due to perceived government efforts (39%) and current real estate climate (52%).

Key finding #1: Satisfied with government policies

In September 2019, the government announced various measures to make public housing more affordable and accessible for Singaporeans, such as the raising of income ceilings to S$14,000 and the newly consolidated Enhanced CPF Housing Grant (EHG) targeted to help first-timer families buying BTO flats.

The study found that younger Singaporeans, aged between 22 and 29, are most optimistic about future property prices. 70% of Singaporeans are looking to buy a home in Singapore, most of which, have intentions to buy within the next two years. Future MRT lines (89%) and government Master Plans (82%) are also cited as key considerations for property purchase.

Dr. Tan Tee Khoon, Country Manager – Singapore, PropertyGuru, said, “Amidst the current macroeconomic headwinds and ongoing COVID-19 situation, we do not expect property prices to significantly drop and we are confident that property prices will remain stable in 2020. Buyers, who are looking to purchase a property this year, should first and foremost consider their needs in their property search and be prudent in their buying decision – calculate their finances and have contingency plans to service mortgage loans in the event of unemployment or an emergency.”

Key finding #2: Most agree with ABSD, 60% want higher LTV limit

2019 was also the anniversary of the cooling measures the government had introduced which includes Additional Buyer’s Stamp Duty (ABSD) rates and tightening loan-to-value (LTV) limits on residential property purchases. While more than half of Singaporeans think that ABSD is successful at stabilising the property market, 60% of respondents also felt that it should be relaxed for citizens buying their second property. Singaporeans also want more leeway when it comes to borrowing for home loans. Just over a third of respondents felt that the ability to borrow 75% of a property’s value is too low. Given 72% of respondents believe that property prices will continue to increase over the next five years – one inference here, is that the desire for more home financing support will continue to be on the uptrend.

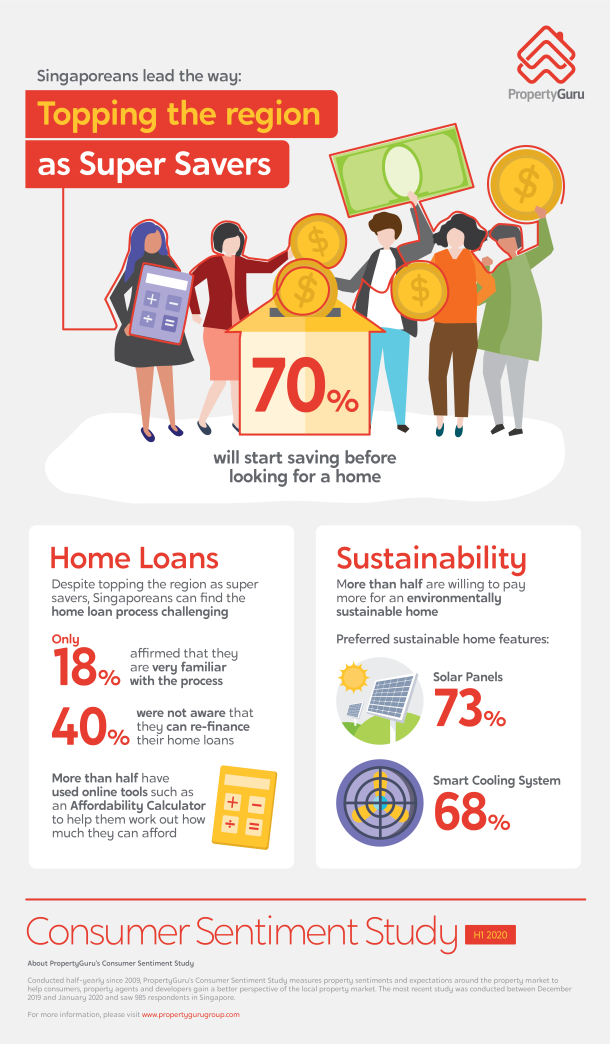

Key finding #3: Singaporeans top the region as super savers; home loan process is a challenge

Singaporeans take the lead in Southeast Asia as super savers with 70% of respondents indicating that they will start saving before looking for a home to buy. This comes as no surprise, as buying a house is one of the biggest life decisions most Singaporeans will ever make. On the other hand, the younger Singaporeans, who are still in the early stages of their lives, are more likely to start saving only after estimating the cost of the home they intend to buy.

When it comes to home loans, only 18% of Singaporeans affirmed that they are very familiar with the process and almost half indicated ‘not being familiar with the paperwork’ as a key challenge they faced. A surprising 40% said they were not aware that they can re-finance their home loans. Singaporeans are also turning to online tools such as an Affordability Calculator for help with working out how much they can afford to buy when selecting a property, with more than half indicating that they have used a home loan calculator before.

Key finding #4: Moving towards a more sustainable future in homes

Singaporeans are becoming increasingly aware of the impact of climate change, and more are open to eco-friendly features for the home. The study found that more than half of the respondents are willing to pay more for an environmentally sustainable home. Both solar panels (73%) and a smart cooling system (68%) top the list of preferred types of sustainable features.

Tee Khoon said, “We are happy to see that sustainability is gaining popularity among home buyers, and to meet the rising demands, more property developers have also incorporated sustainable solutions into their residential projects. Together with new government initiatives such as the HDB Green Towns Programme, we are definitely moving one step closer to the goal of a sustainable future.”

You can read the official Press Release here.

About PropertyGuru’s Consumer Sentiment Study:

Conducted half-yearly since 2009, PropertyGuru’s Consumer Sentiment Study measures property sentiments and expectations around the property market to help consumers, property agents and developers gain a better perspective of the local property market. The most recent study was conducted between December 2019 and January 2020 and saw 985 respondents in Singapore.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.