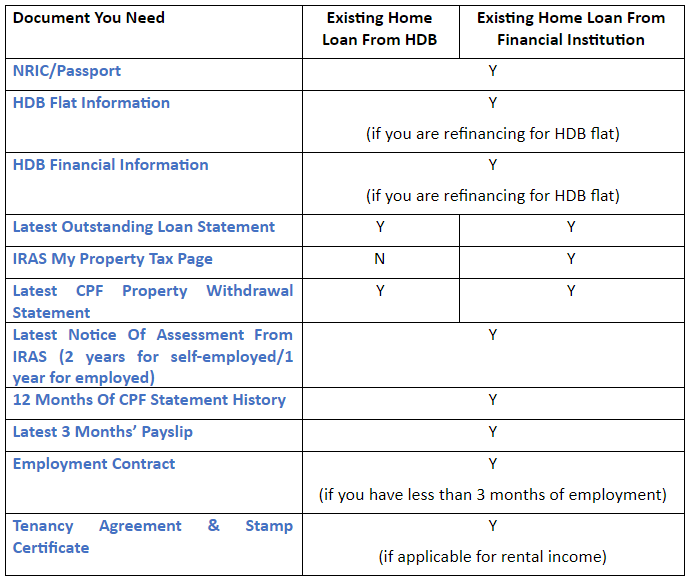

Whether you’re just starting to think about refinancing or you’ve already shortlisted your top home loan packages, you’ll need 4 key documents to begin the process. Being prepared and having the right paperwork can make all the difference in securing a better rate to save more money in the long-run. Keep reading to find out the documents you’ll need to refinance your mortgage.

Documents to refinance your home loan

1. Refinancing your HDB flat

To refinance your HDB flat, you will need information about the flat as well as your current financial situation. The flat information includes details of when you purchased your HDB, the purchase price and your flat’s occupiers. The financial information contains information about your account balance on your mortgage loan, whether that’s from HDB or from another financial institution.

To access this information:

- Login to MyHDBPage via SingPass

- Select ‘My Flat’ on the menu

- Choose ‘Purchased Flat’

- Click ‘Financial Info’ and ‘Flat Details’ to download a copy

2. IRAS My Property Tax Page

When you refinance your home loan, the financial institution will want to know whether the property is owner occupied for the purpose of TDSR exemption. If the property is occupied by the owner, TDSR requirements become less stringent. That’s why you need to download the information from your IRAS MyTax portal as one of the documents for submission to the financial institution.

To download the My Property Tax Page:

- Login into the IRAS MyTax portal

- Select the ‘Property’ tab

- Click ‘View Property Portfolio’

- View and download the details of your property portfolio

3. Latest IRAS Notice Of Assessment

In order to extend a home loan to you, the financial institution needs to know whether you have the financial capability of repaying the loan. The financial institution uses your income as a gauge of your financial capability of repayment. This is why you also need to submit your latest IRAS notice of assessment when you are applying to refinance. The Notice of Assessment contains your annual income for the latest financial year and how much tax you were subjected to.

To download your Notice of Assessment from IRAS:

- Login into the IRAS MyTax portal

- Select ‘Notice’ tab and then ‘Individual’

- Download the latest ‘Notice of Assessment’

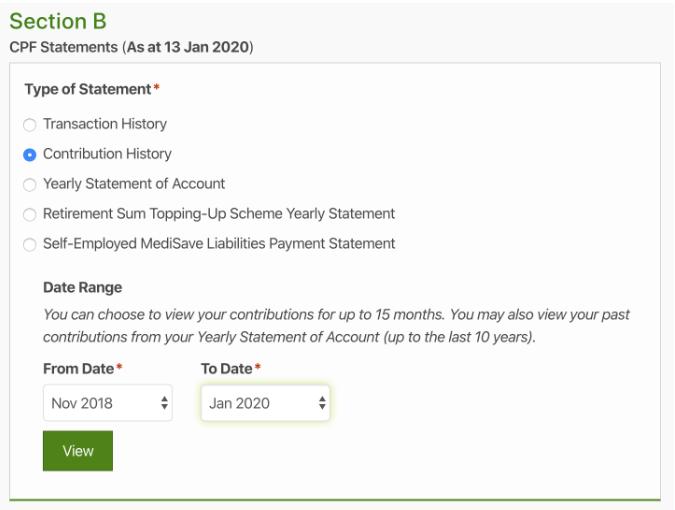

4. 12 months of CPF contribution

Apart from your IRAS Notice of Assessment, you will also need to provide 12 months of CPF contribution statements.

To download 12 months of CPF contribution statements:

- Login to your CPF account via SingPass

- Under ‘Section B’, select ‘Contribution History’

- Choose 12 months as period of contribution

- View and download the statements of CPF contribution

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.