Luxury apartments in Singapore.

Given the higher land prices and anticipated market recovery, new private home prices will likely be higher in 2018.

The private residential market is widely expected to perform better in 2018 due to improved consumer sentiments. According to PropertyGuru’s latest Consumer Sentiment Survey, many potential buyers are looking to make their purchase in the next few months driven by the strengthening property market.

What are the factors driving this improved sentiment and is there any merit to it?

After languishing in the doldrums for the last two years, Singapore’s economy has improved significantly. GDP grew by 4.6 percent year-on-year (y-o-y) in Q3 2017, up from 2.9 percent y-o-y in Q2 and 2.0 percent y-o-y in 2016. The stellar performance in Q3 2017 was due to improvement in the manufacturing sector, but a more broad-based growth is expected as other sectors continue to strengthen and gain momentum.

The Singapore government projected that GDP will grow by 3.0 percent to 3.5 percent for the whole of 2017 and 1.5 percent to 3.5 percent in 2018. In addition, the unemployment rate fell from 2.2 percent in Q2 2017 to 2.1 percent in Q3 2017. The recovering economy gives potential home buyers more confidence to go ahead with their purchase.

Recognising that prices in the private residential market have stabilised, the government lowered the Seller’s Stamp Duty (SSD) rate in March 2017. At the same time, the government reduced the time frame when SSD will apply from four years from the date of purchase to three years. The adjustment in SSD has given potential investors more peace of mind and confidence because they know that they can sell their investment property earlier without incurring any stamp duty.

While the adjustments in SSD did not inspire a flood of buyers to the private residential market, it certainly gave the market a significant boost. The number of transactions in the primary market has seen a vast improvement in 2017. For the first 11 months of 2017, the Urban Redevelopment Authority (URA) reported that 11,127 brand new units were sold, far surpassing the 7,972 and 7,440 units sold during 2016 and 2015 respectively.

Primary market sales for 2017 crossed the 10,000 mark for the first time since 2013; a strong indication that the demand for private residential units is definitely picking up and the market is well on its way to recovery. In addition, the unsold inventory level is at a historic low of 17,000 units. Assuming that transaction volume is maintained at about 11,000 units per year, all currently unsold units are likely to find owners before the end of 2019.

The active en bloc sales market has given a significant boost to consumer sentiment and demand. In 2017, some 20 developments comprising over 3,000 units were sold via collective sales; far surpassing the total in the previous few years. Many of the 3,000 displaced households from the on-going en bloc sales will have to buy a replacement property. These displaced households are likely to look to the resale private residential market to fulfil their immediate housing needs. Their small windfall from the en bloc sale also means that they have more than adequate funds to finance their new home.

There are two main factors driving the current vibrant en bloc market. Firstly, the government tapered the number of land parcels launched for tender under the Government Land Sales (GLS) programme during the past few years. Secondly, many developers are slowly running out of land to develop and available inventory to sell. With less land available from GLS, developers have to turn to the en bloc market to obtain land despite it being a more long drawn and complex process. However, developers have little choice because they need to replenish their depleting land bank.

The aggressive bids by developers for residential land also mean that the breakeven cost for these projects will be higher. As such, residential prices can only go up in the near future. This fear that prices will increase even further has encouraged many buyers, who were sitting on the fence, to finally take the plunge.

In fact, prices have already started moving upwards because some sellers and developers have started to price the anticipated increase into their asking prices. This is clearly seen in the PropertyGuru Property Index (Singapore, Price), which showed a 1.6 percent y-o-y increase in Q3 2017 (refer to Figure 1). At the same time, the URA price index finally showed an increase in Q3 2017 after 16 consecutive quarters of decline. This upturn cycle for private residential property prices is expected to be more sustainable and less speculative because it is supported by a stronger economy and genuine demand.

However, it is not all rosy. In December 2017, the Monetary Authority of Singapore (MAS) warned of “excessive exuberance” in the property market arising from increasing land prices and the upcoming supply of some 20,000 units from recently sold land parcels from GLS and collective sales. In addition, the government has kept the supply of land via GLS for H1 2018 at the same level as H2 2017. Taking into account the still cautious stance of the government, it is unlikely for the government to ease any cooling measures in the near future.

Additionally, interest rates for mortgage loans are on a gradual upward climb. The three-month SIBOR had been under 1.0 percent since July 2016, but has been above 1.0 percent since August 2017. As at December 2017, the rate has hovered around 1.2 percent. The rise in interest rates will push up the amount of mortgage payable each month and thus negatively impact home buyers’ ability to afford a home.

For some home buyers, the higher mortgage payments may bar them from making their purchase because they are unable to fulfil the Total Debt Servicing Ratio (TDSR) requirements. Investors, especially those with multiple investment properties, may become overleveraged especially since rentals for private residential properties remains weak.

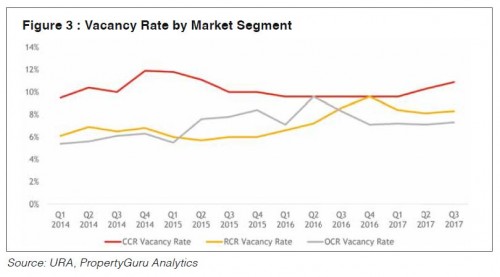

The URA rental index for non-landed private residential properties indicates that rents are still declining albeit at a slower pace. The vacancy rate is about 8.4 percent for condominiums (refer to Figure 3). It is clearly still a tenant’s market with numerous available units. Bearing in mind the tight control over the number of foreign workers allowed into Singapore, rental demand for private residential units is likely to remain weak. As such, investors must have enough funds to keep paying their monthly mortgage even if there is no rental income for several months. In addition, the keen competition for tenants is expected to continue putting downward pressure on rents.

So, is 2018 an appropriate time to buy private residential properties in Singapore? The answer is yes, especially for owner-occupiers. Prices have moved up but the increase is slight. In general, prices are still low compared to the peak years. Additionally, prices are expected to increase further in the next few years, fuelled by the strengthening economy and improving demand. Interest rates are still low despite recent upward movements. However, owner-occupiers still have to do their sums carefully and take into account the increasing interest rates. Investors have to ensure that they have sufficient funds to ride out the still weak rental market.

|

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | ||