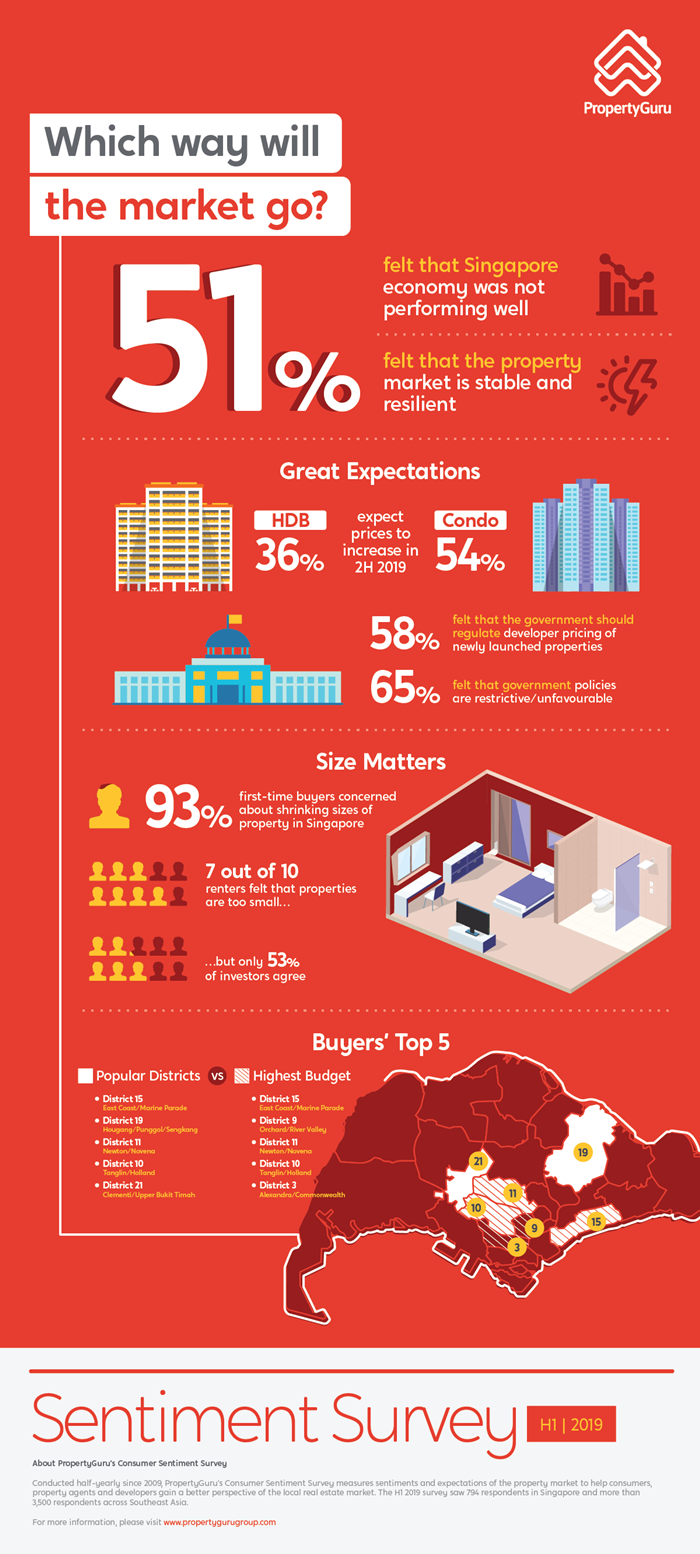

Nearly 70% of Singaporeans believe that Singapore properties are too small, according to the latest findings in the 1H 2019 PropertyGuru Consumer Sentiment Survey. Diving deeper into the demographic profiles of the survey’s 794 respondents revealed a bigger trend: seven out of 10 (70%) renters felt that property sizes in Singapore were shrinking, whereas only 53% of investors and 59% of landlords seemed to think the same.

Mismatch in landlord and renter expectations

While there are whispers that smaller homes are getting more popular among investors and young couples, the recent survey results indicated that significantly more renters feel dissatisfied about the shrinking property sizes compared to investors and landlords.

Tan Tee Khoon, Country Manager of PropertyGuru Singapore, cautioned that investors should take heed of the disparity among landlord and renter expectations.

“This finding is a sobering discovery for property investors, who would do well to focus on liveability and meeting the spatial comfort of prospective tenants rather than just looking at the quantum of their purchase when making a property investment. For instance, renters may ultimately prefer a 500 square foot one-bedder over a 400 square foot unit,” he said.

Most Singaporeans expect rent to fall

Majority of those surveyed also expects rental prices to decrease for the rest of the year across HDBs, condominiums, and landed properties. For HDB flats, 29% felt that rental prices will fall, in contrast to the 25% who believe that rental prices will increase.

Condominiums saw the softest sentiments on rental: over one-third (36%) of respondents also felt that condominium rents would decrease overall, while 28% expects condo rental prices to increase. For landed properties, 30% also felt that rental prices for landed homes will decrease, compared to just 24% who felt that rental prices would increase for the rest of 2019.

"In Singapore, the competition among landlords is already beginning to be felt, with over 25 condos attaining Temporary Occupation Permit [TOP] this year," said Tee Khoon. "The increase in supply is most significant in the Outside of Central Region [OCR], and investors of those properties will feel that they need to reduce their asking rent to avoid prolonged vacancies with the dampening economic outlook."

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.