(This commentary on HDB lease is a guest post by He Shen Chow, Charlie.)

What did Lee Kuan Yew really mean when he said that 99-year HDB flats will enjoy generous HDB upgrading and their value “will never go down”.

Did he really mean that the value of a HDB flat will never go down indefinitely?

Or did he mean that with the policy of upgrading, a flat will continue to rise in value in the foreseeable future of 33-39 years?

Many older Singaporeans who bought their HDB 35 years ago would have seen their flat appreciate from $50,000 to $500,000 (on the average) when they retire.

To the majority of Singaporeans, their home is their largest asset and nest egg, 82 percent of which are HDB homes. HDB values will shrink to zero when they reach 99 years old. So what?

It is profoundly confounding that many Singaporean intellectuals have come to a collective view that an HDB residential asset with a 99 year lease is a poison chalice because, at some stage in the future, its value will shrink to zero.

Yet, professional developers of industrial warehouses, shopping malls and casinos in Singapore bid sky high prices for land leases ranging from 25 to 50 years and spend billions on building these facilities.

Where is the HDB owner’s fear coming from?

It is understandable that HDB owners are anxious. But is this anxiety grounded in truth and fact? After all, 99 years is a very long tenure for the first-time HDB owner to feel financially insecure.

Those who purchased a 35-year-old HDB flat at market prices are a different breed. They have different considerations and financial abilities. It is not the government’s duty to ensure that the flat outlives these secondary market buyers.

The government’s sole duty, when it comes to housing, is in the primary market, ensuring affordable new HDB flats to a fresh generation of young Singaporeans.

Leasehold bad, freehold good?

What could be the root cause of this bifurcation of thinking between leasehold and freehold?

The answer lies, in my view, on the lack of understanding of basic finance.

In reality, leasehold and freehold are two sides of the same coin.

If markets are reasonably efficient, buying a leasehold property should not be inferior to buying a freehold property. For instance, in London, United Kingdom, the prime real estate in the city sits mostly on leasehold titles.

Critics will argue that London leases are renewable. That said, ground rent must be paid by lessees to renew each time.

Take for example two properties side by side and similar in every way except (a) one is a 33-year leasehold property X (b) the other is a freehold property Y.

If the professionally appraised market value of freehold Y is $5 million, what should leasehold Property X sell for?

A retired couple who are aged 65 are weighing the options. How would they decide?

Say they are planning to live in either Property X or Y till they die. From an actuarial sense, either property will outlive them.

If their long-term opportunity cost of capital is 4% per annum, they should be indifferent toward paying $1.37 million for leasehold Property X or paying $5 million for freehold Property Y. Here’s why:

How did we get the market value for leasehold Property X? Well, $1.37 million is the present value (PV) of the future value (FV) of $5 million discounted over 33 years at 4% per annum.

Choosing Property X will free the couple of $3.63 million. Choosing Property Y means that all of their $5 million is tied up in the freehold home.

Freehold Y is expected to appreciate in 33 years, whereas Leasehold X’s value will drop to zero in 33 years.

But the retired couple, should they choose to buy leasehold X, will instead have the freed-up capital of $3.63 million to invest at 4% per annum for 33 years. The future value of this investment would equal $13.24 million.

How much will freehold property Y appreciate in 33 years?

Theoretically it should be worth the compounded value of $3.630 million @ 4% for 33 years = $13.24 million.

So, whether you decide on house X or Y, the outcome should be similar.

Leasehold: Renting to self

Another way of looking at option X (i.e. the 33-year leasehold property) is to imagine that the buyer is buying the leasehold property to rent to herself for 33 years, being his/her own landlord. The implicit rental is this case is $6,290 per month, for 33 years.

In financial calculations, knowledge about the power of compounding and discounting cash flows over long periods of time is non-intuitive.

Hence, many non-financial intellectuals could be forgiven for thinking that assets, when compounded/discounted at a risk adjusted “cost of capital”, appreciate/depreciate linearly, when it in fact resembles an exponential relationship (e.g. decreasing at an increasing rate).

As a thought experiment, we use a 5% discount rate to compute the relationship between the PV and FV over a 99-year period. Applying this, a million dollars 99 years from now is worth only about $8,000 today, which means HDB could theoretically promise to buy back every flat after 99 years for $500,000 (i.e. when HDB sells a new flat each time, it makes a provision of $4,000 in today’s dollars).

The PV of $5,000 of cash inflows per year, over 33, 66 and 99 years, discounted at 5% per annum, are $80,000, $96,000 and $99,000 respectively.

The financial calculations above have shown us that cash received AFTER 33 to 39 years show an exponential decrease in value.

Although it is non-intuitive, but the idea of buying a new HDB flat is actually similar to paying a sum of money upfront (PV) in exchange for a fixed annual stream of cash flow over 99 years.

This also explains why an HDB flat reaches its peak market value when it is 33 to 39 years old.

Be it a 99-year HDB leasehold or 33-year private leasehold, the financial valuation principles are similar.

Unlike a pure landlord-tenant contract, the HDB flat “owner” is permitted to sell her flat at market price any time during the lease period.

Why does a new HDB flat appreciate the most during the first 33 to 39 years?

The financial implication of an HDB purchase is that it is most impactful during the first 33 to 39 years.

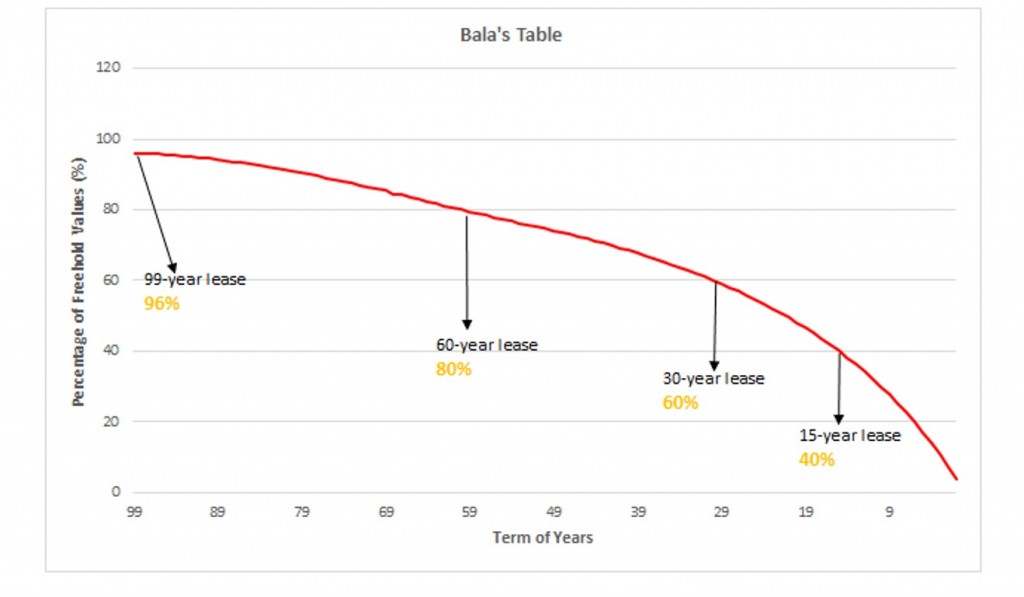

The 99-year HDB lease is fair and generous. Refer to Bala’s table below, which is based on the leasehold table by the Singapore Land Authority (SLA). It shows that the value of any 99-year leasehold property holds up well against the value of freehold for the first 33 to 39 years of the lease (the numbers in yellow is leasehold value as a percentage of its freehold value).

This is consistent with discounting a fixed cash flow stream over a 99-year period, where the PV of the first 33 to 39 years of cash flow is 80% of the entire 99-year stream.

Although this may not seem intuitive, it basically explains why the market value of an HDB flat rises to its peak level between 33-39 years of age.

In fact, during the first 33 to 39 years of owning an HDB flat, the capital appreciation mirrors that of freehold property.

HDB’s responsibility to the nation

Centuries ago, great thinkers like David Ricardo and Henry George have identified that aristocratic landowners had the ability to extract economic rent, carving out a lion’s share of the growth created in an economy, without contributing much.

The modern-day rentier is still alive. These are the real estate oligarchs of Hong Kong who collude to horde land, to the detriment of the masses.

In Singapore, the government is the “benevolent” rentier, regenerating residential land in 99-year cycles so that many more generations of young Singaporeans will continue to buy affordable HDB housing.

It’s important to know that HDB flats aren’t purely financial transactions between state and citizens. HDB policies impact nationhood, nation building and social-economic-political behaviour.

HDB flats in a particular location, like all real estate projects in Singapore, does well when the government improves liveability. This is done by building amenities, such as shopping malls and MRT lines that serve the HDB estate.

In addition, individual HDB flats and blocks also receive unique upgrades to enhance their liveability and value.

There is a healthy social contract between HDB and citizens, in addition to a financial contract.

Poverty/retirement issue and leasehold policy: two different issues

It is true that there are 100,000 poor Singaporeans living in HDB, including 50,000 rental studios for those who are really poor, with little money to retire on.

Poverty and retirement inadequacy are global problems, in both rich and poor countries today.

Many critics will argue that because CPF money is used in HDB flat purchase, hence the two issues are linked. But CPF money is used for private home purchases as well.

It is possible that owners of private freehold properties in Singapore who steadfastly hold on to their asset, without any retirement income for years, will run into cash flow problems.

Be it an HDB or private homeowner, retirement is about unlocking hard assets in exchange for liquid assets and balancing the two assets smartly.

Hence, one should not conflate the poverty and retirement crisis with HDB leasehold policy.

Separate government policies are needed to solve the problem of poverty and retirement adequacy.

The 99-year HDB lease is generous and adequate. If a young Singaporean couple buys an HDB at 30 years of age, the lease will expire when they are 129 years old.

Every fresh generation of young Singaporeans is entitled to buy a new and highly subsidised HDB flat for themselves, and they should.

No government can guarantee that every generation of Singaporeans can garner surplus wealth to pass down to their heirs.

Every government’s responsibility is look after one fresh generation at a time.

The ability for some Singaporeans to leave a legacy, either with freehold property or with gold bars, is a privilege and not a political right. (Freehold property is scarce; it makes up a tiny fraction of all property in Singapore.)

The author’s advice for retiring Singaporeans

Singaporeans should be smart about making retirement choices.

A 65-year-old couple who bought their HDB flat 35 years ago for $50,000 have options. These include:

- Selling the flat at market value, say $500,000, and right-sizing to a HDB 2-room Flexi flat

- Selling part of the remaining lease to HDB (Lease Buyback Scheme) and continue to live in the flat. Renting out a room is also a possibility, with or without selling lease to HDB.

- Selling the flat for $500,000, and along with other savings, uproot and retire in a location like Penang (If many westerners already do that, why not Singaporeans?)

- Renting the flat for $2,500 per month and along with other sources of income, move next door to Iskandar and enjoy a good life for 12,000 MYR per month. For option (4), it is interesting to note that even as the HDB flat value declines sharply, especially during the final 20-30 years, their rental value remains the same as freehold.

The author of this piece, He Shen Chow, Charlie, is a Singaporean-born private investor and family office fund manager.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.