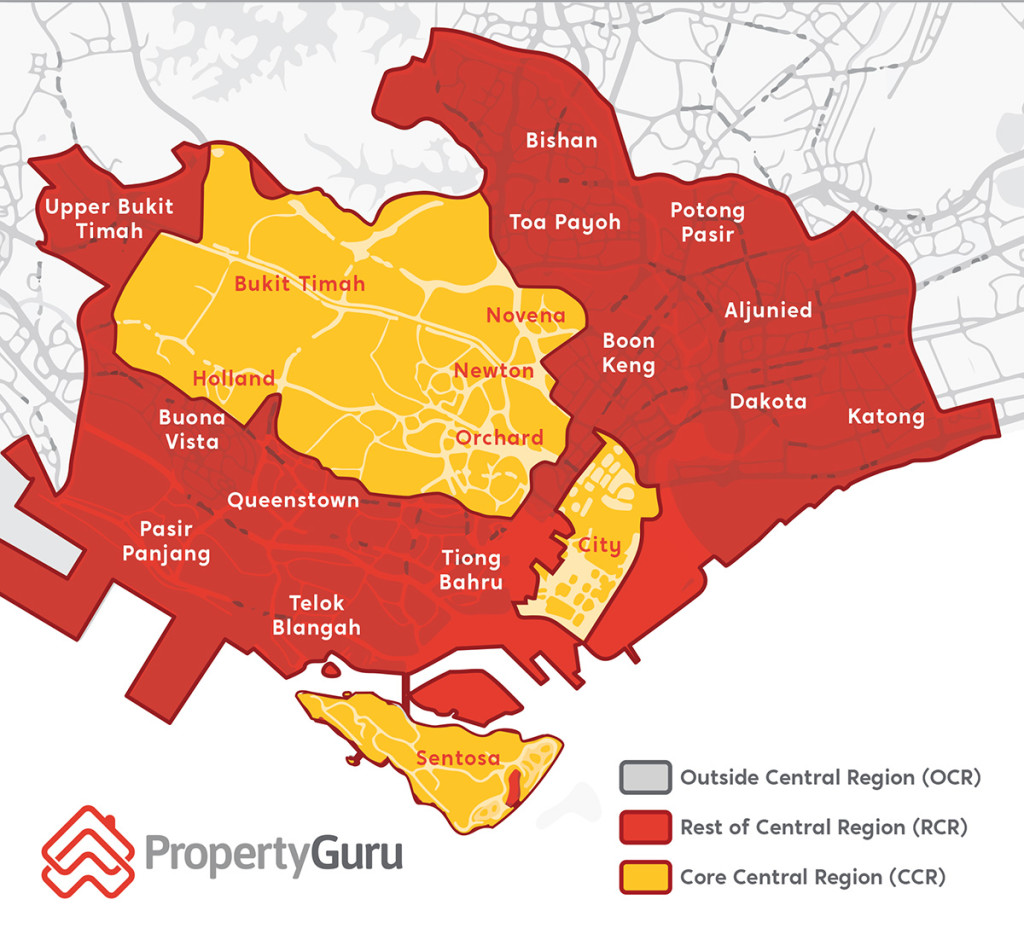

The city fringe, classified as the Rest of Central Region (RCR) in Singapore, is arguably the fulcrum of change in Singapore’s property landscape. Modern developments and infrastructure are breathing new life into established locations such as Geylang and Queenstown. Property investors, in particular, are cognizant of the uplift in property value that accompanies the rejuvenation of the city fringe.

RECOMMENDED ARTICLE: Defining the CCR, RCR and OCR in Singapore

City Fringe condos in Singapore: a prime rental market?

In Singapore, properties in the Rest of Central Region (RCR) may benefit from the confluence of demand from various buyer groups, including foreigners looking for a good buy, Singaporean investors, owner-occupiers who want to live closer to the city, as well as a sizeable pool of budget-conscious tenants who might be priced out of the prime rental market in the city centre.

For Singapore, strategic growth areas and infrastructural developments will augment the intrinsic locational advantage of city fringe properties. “In the coming year and decade, we foresee the positioning of RCR projects to change as upscale developments spill over from the Core Central Region (CCR) and its prime districts to the RCR,” said Tan Tee Khoon, Country Manager-Singapore at PropertyGuru.

Furthermore, rents in the RCR have been outperforming other regions since 2014, according to the URA Rental Index for non-landed properties, which makes city fringe condos in Singapore even more appealing to property investors seeking rental yield.

For ageing precincts such as Beauty World and Rochor, it is foreseeable that new developments or redevelopments will provide much-needed booster shots to surrounding property value. This may give rise to a ripple effect that encourages developers to hop onto the rejuvenation bandwagon and buyers to give the area greater consideration.

Median RCR home prices now closer to CCR than OCR

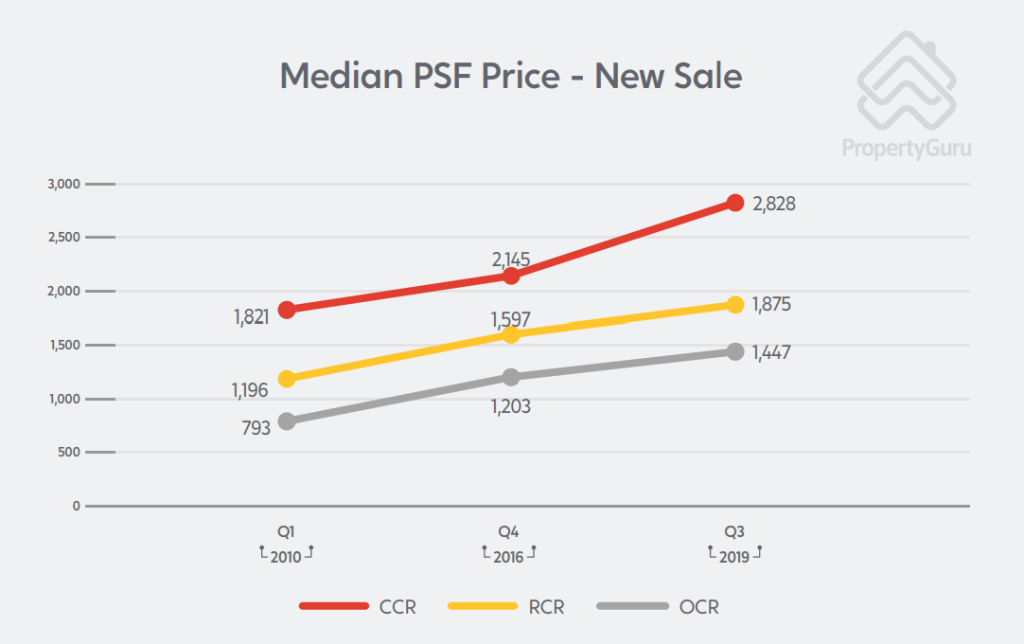

In the course of the past decade, overall median psf prices of non-landed private properties in the RCR have increased 42 percent from S$1,035 psf in Q1 2010 to S$1,802 psf in Q3 2019. “With the pace of rejuvenation of the built environment, there is likely further room for city fringe condo property value to increase,” Tee Khoon noted. “The addition of new homes and amenities will create a virtuous cycle of rising value.”

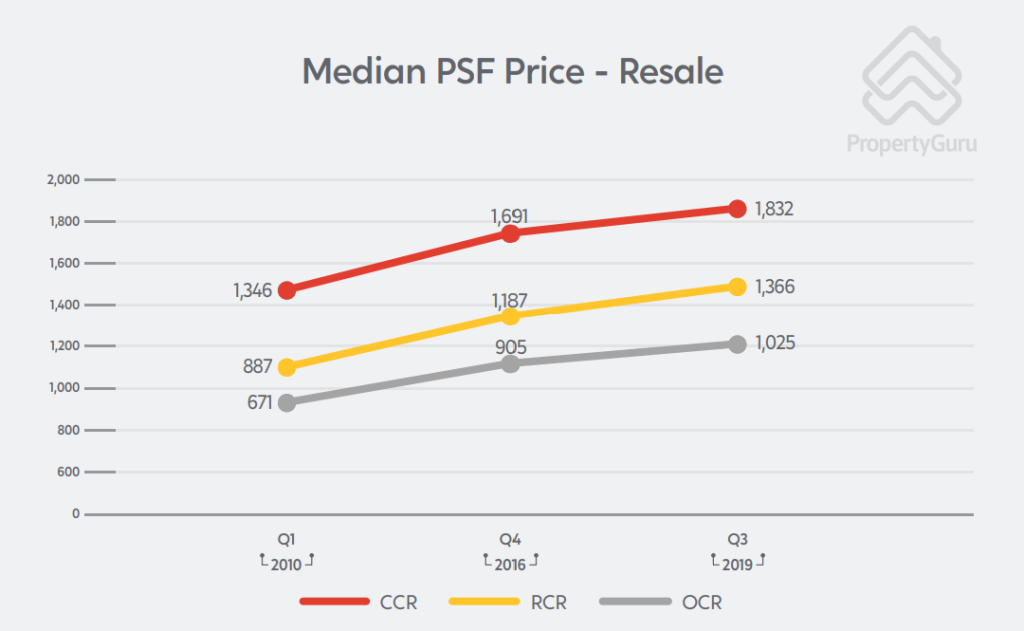

In Q3 2019, the median RCR psf price of $1,802 was closer to the CCR price than OCR price, unlike at the beginning of the decade when the RCR psf price of $1,035 was closer to the OCR price than the CCR price. The most recent RCR median psf price is buoyed by new launches just outside the CCR, such as Sky Everton (District 2) and Avenue South Residence (District 3).

Back in Q4 2016, it is likely that the average home buyer did not regard new sale, direct-from-developer city fringe condos (i.e. RCR private properties) as being able to command a higher price than a resale property in the CCR (a median psf price of S$1,597 versus S$1,691 respectively).

In Q3 2019, however, the perception was turned on its head: new sale RCR properties commanded a median psf price that was higher than that of CCR resale homes (S$1,875 versus S$1,832).

“In 2019, a newly launched city fringe condo is, in the eyes of your typical buyer, seen as ‘more worth it’ than a resale property in the city or in a prime district,” explained Tee Khoon. New sales for projects such as Avenue South Residence and Park Colonial are pushing RCR median prices to new heights.

RECOMMENDED ARTICLE: What’s New in the URA Master Plan 2019? [Part I of II]

City fringe condos make up nearly half of all recent new launches

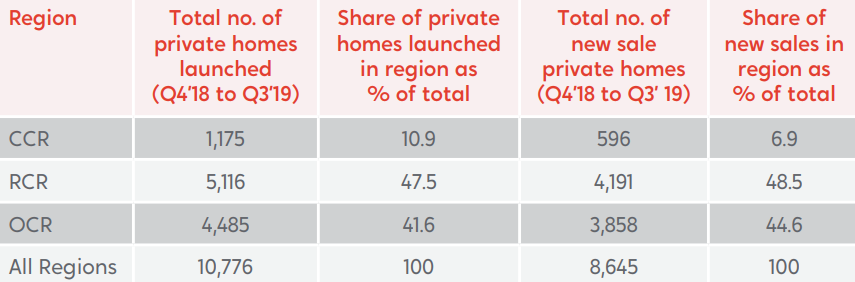

Also notable is the growing proportion of new launches in the RCR region, which in the past four quarters accounted for roughly half (47.5 percent) of all new launches despite only occupying 15 percent of Singapore’s land area.

In 2020, although the RCR may take a backseat to the CCR in terms of the expected number of new residential projects, PropertyGuru foresees uptake for existing uncompleted RCR projects, such as Parc Esta and Jadescape, to continue at 2019 rates.

“What’s surprising about the newly launched residential units in the city fringe region is that, despite the price premium these homes are fetching, buyers are actually putting down their money,” Tee Khoon added. In the past four quarters, 48.5 percent of new launch private homes sold are from the RCR, reflecting a healthy uptake of developers’ new projects.

This article is an excerpt from the PropertyGuru Market Outlook 2020. Get the full report here.

Disclaimer: The information is provided for general information only. PropertyGuru Pte Ltd makes no representations or warranties in relation to the information, including but not limited to any representation or warranty as to the fitness for any particular purpose of the information to the fullest extent permitted by law. While every effort has been made to ensure that the information provided in this article is accurate, reliable, and complete as of the time of writing, the information provided in this article should not be relied upon to make any financial, investment, real estate or legal decisions. Additionally, the information should not substitute advice from a trained professional who can take into account your personal facts and circumstances, and we accept no liability if you use the information to form decisions.