This comes as the progressive reopening of Singapore’s economy from early June saw an uptick in residential transaction volumes.

The healthy take-up of recent projects since the reopening of Singapore’s economy should provide developers with some degree of optimism.

“With an estimated 20 projects expected to be launched over the remainder of 2020, and barring further adverse externalities, transaction activity is anticipated to register a gradual improvement for the rest of the year,” it said in its latest report.

This comes as the progressive reopening of Singapore’s economy from early June saw an uptick in residential transaction volumes.

In fact, new home sales more than doubled from 487 units in May to 998 units in June, and continued to increase in July, hitting 1,080 units, which is the highest since November 2019, when 1,165 units were recorded.

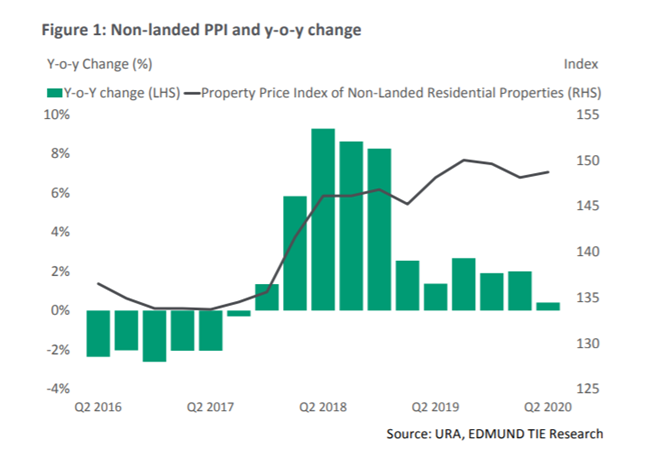

After a 1% decline in property prices in Q1 2020, overall private home prices rebounded by 0.3% quarter-on-quarter (q-o-q) in Q2 2020, based on the URA All Residential Property Price Index (PPI). On a year-on-year (y-o-y) basis, property prices saw an increase of 1.2% in Q2 2020, in spite of the current COVID-19 pandemic.

Diving deeper into the pricing trends, there was a 0.4% increase y-o-y in the Non-Landed PPI. Among the market segments, only the Rest of the Central Region (RCR) saw a q-o-q decline of 1.7%, whilst the Core Central Region (CCR) and Outside Central Region (OCR) both saw a 2.7% and 0.1% increase respectively.

Meanwhile, the Landed PPI remained unchanged in Q2 2020 after a q-o-q decline of 0.9% in Q1 2020. On a y-o-y basis, the Landed PPI still recorded an increase of 3.7%.

Suggested read: Landed property in Singapore: Terrace houses, bungalows and semi-detached houses

Edmund Tie’s Senior Director of Research and Consulting Lam Chern Woon attributed the rebound to the pent-up demand in June, when the economy began to open up and showflats were allowed to resume operations.

The relatively healthy property performance was also attributed to the low-interest rate environment as well as the high amount of liquidity within the system.

“Underlying demand remains relatively strong, notwithstanding the sluggish economy, as buyers adopt a mid- to long-term view of the market to buy into well located and designed projects,” said Ong Choon Fah, Chief Executive Officer of Edmund Tie.

“Some developers have also offered ‘star buys’ and incorporated flexible design features and wellness into their designs, making them particularly attractive,” she added.

Read also: PropertyGuru Monthly Market Roundup: August 2020 in Review

Although overseas demand has been affected by travel restrictions, Singaporean purchases made up for the slack, accounting for 80% of non-landed home sales in Q2 2020, up from the previous quarter’s 77%.

And with buyers remaining cost-conscious, the proportion of apartment transactions under $1 million increased five percentage points to 25% in Q2 2020 from the previous quarter.

But while buyers gravitated towards a lower price quantum, the proportion of transactions for units measuring below 500 sq ft declined. In Q2 2020, this category of apartments made up just 10% of total transactions, down from Q1 2020’s 14%.

Meanwhile, the proportion of transactions for units measuring 500 sq ft to 700 sq ft increased three percentage points to 36% in Q2 2020.

“The shift away from compact units under 500 sq ft to more spacious homes could be arising from the fact that more employees are working from home,” said Margaret Thean, Executive Director of Residential Sales at Edmund Tie.

“Going forward, as remote working becomes more prevalent in the new normal, apartments would need to have multi-functional layouts that facilitate seamless transition across living, working, studying and entertainment.”

Looking for a property in Singapore? Visit PropertyGuru’s Listings, Project Reviews and Guides.

Victor Kang, Digital Content Specialist at PropertyGuru, edited this story. To contact him about this or other stories, email victorkang@propertyguru.com.sg