Special Advertising Feature: Should an HDB upgrader consider a private property or an EC? Below are a few things you need to consider before you move on to your next property decision!

For many Singaporeans, their first home would most likely be an HDB flat. But there’s a high likelihood that this may not be your “forever home”, especially as you go through different life stages and your needs grow or evolve.

For instance, you may have picked a modest starter home that was better suited for a young couple. But now you have two kids and toys that stack up to the ceiling. Or you may have moved higher up the corporate ladder and can now afford a nicer home.

It is also typically around this time when the dilemma as to whether you should look into upgrading to an executive condo (EC) or a condo arises.

In this article, we will delve into a few things that you will need to consider before you move on to your next property decision!

1) Closing Gap of Prices Between ECs and Condos

While the common assumption is that ECs are typically priced significantly lower than private properties, the gap between ECs and mass market condos located in Outside Central Region (OCR) has been observed to be narrowing in recent years.

For example, the EC, Rivercove Residences set a new high for EC prices when it came close to breaching the $1,000 per square foot (psf) threshold during its April 2018 launch. On a psf basis, this reflects an increase of nearly 22% from the year 2015 (as shown in the chart below).

Recent trends suggest that prices of new EC projects would continue to rise. For instance, the site of the upcoming Piermont Grand EC was sold at about $583 psf per plot ratio (ppr), which means that the estimated breakeven price for units at the development would be around $1,000 psf or higher.

This new threshold in new EC prices comes quite closely to the prices of certain new projects in the Outside Central Region (OCR) within the same quarter. One such example would be the Riverfront Residences, whose units currently start from just over $1,100 psf.

Developed by an Oxley-led consortium, Riverfront Residences was among the new projects whose launching dates was brought forward following the announcement of the new property cooling measures on July 5, 2018. The project sold over 500 units overnight following the announcement, right before the new measures took effect the next day.

The project occupies the site of the former Rio Casa, a 286-unit privatised HUDC estate. To date, over 1,050 units at the development have been sold and it was the best-selling project in 2018.

2) Buying and Selling Restrictions

- Buying restrictions

There are certain restrictions that come with EC ownership. For example, you are required to apply as a family nucleus or as a couple, and only Singaporean couples and Singaporean/permanent resident couples are eligible to buy a new EC unit. The couple must also not exceed the household income ceiling of $14,000 a month.

Private properties on the other hand, do not have such prerequisites and buyers are free to purchase a unit regardless of residential status or marital status.

- Selling Restrictions

For EC owners, there is also a 5-year Minimum Occupation Period (MOP) requirement to fulfil before you can sell your unit in the open market.

If you factor in the construction period, which typically takes up to three years, an EC owner will then only be able to sell their unit after an eight-year period. This could present an opportunity cost, since owners do not have the flexibility to time the sale of their unit within the eight-year period.

Also note that you can only invest in private residential property after the 5-year MOP after you buy an EC, which could present certain setbacks especially if you come across an attractive investment opportunity.

3) More accessible loan terms

For property buyers, the process of obtaining a larger loan amount is likely to be more seamless and more accessible when purchasing a private condo.

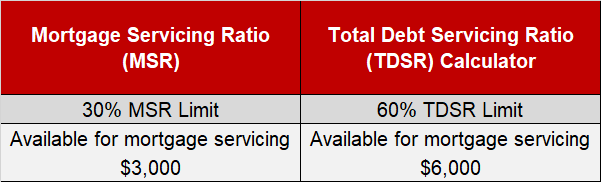

The reason for this lies in the stringent loan terms surrounding EC purchases. For instance, condo loans are subjected to the Total Debt Servicing Ratio (TDSR), which stipulates that total monthly payments on all loan payments (including new property loans) must not exceed 60% of a buyer’s total gross income.

Here is where things could get tricky for EC buyers. Because on top of TDSR, loans taken out for EC purchases will also have to fulfil a more stringent Mortgage Service Ratio (MSR) criteria. MSR must not be more than 30% of the buyer’s or buyers’ gross monthly income.

For example, assuming that you are a couple and that you earn a combined gross income of $10,000 and have no existing loan obligations, here’s how much of your salary that you can utilised to service your mortgage:

- The difference between MSR and TDSR limits

Source: PropertyGuru

Find out more about your affordability with PropertyGuru’s comprehensive range of mortgage calculators.

Given these constraints, the loan amount obtained under MSR guidelines could then be lower compared to a loan amount obtained under TDSR. What this means is that property seekers could potentially run into more hurdles if they’re looking to obtain a larger loan amount for an EC purchase compared to if they’re buying a private property.

4) Investment potential

The biggest advantage to owning a condo lies in its flexibility, and you are not bound by terms and conditions that could hamper your desire to sell or to rent out your property.

For a start, there are no MOP requirements. Having this flexibility allows you to time the sale of your property better, such as during a market high or when market conditions are favourable, when selling your property.

There are also no restrictions on foreign ownership when it comes to private properties. On the other hand, beyond the MOP – EC owners can only sell their unit to Singaporean citizens or permanent

residents after the 5-year requirement period.

After the 5-year MOP, they will have to wait another five years (that’s 10 years in total) before the property is fully privatised, and can be sold to foreigners, leaving EC owners a smaller pool of potential buyers.

MOP requirements also apply for rentals, so if you’re looking to rent out your property for income, do note that only private property owners have the option of renting out their entire unit right after its completion, since condos do not come with any MOP requirements. Meanwhile, renting out the whole EC unit within the 5-year MOP is not allowed.

Viewed from this perspective, if you have seek to have some flexibility in your property in order to maximise your earning potential, then purchasing a condo may be the better choice.

Check out our in-depth project review of Riverfront Residences here!

Looking for an affordably-priced condo to live in or for investment? Head down to the Riverfront Residences showflat at Upper Serangoon Crescent (opposite Block 471A). It is open daily from 10am to 7pm. You may also visit the Riverfront Residences website or call +65 6438 0202 for more information.