With easy access to the CBD and the new Sports Hub, Tanjong Rhu is a popular city fringe location for home buyers and investors.

In this edition of the Guru View, we run the numbers for the real estate market in Singapore’s city-fringe, and highlight some growth areas to take note of.

by Chang Hui Chew

Singapore’s Rest of Central Region (RCR) is a popular location for potential home buyers and investors. Many of the neighbourhoods in the RCR feature the amenities and convenience of suburban locations, such as schools, supermarkets and community centres, but are a short commute away from either the Central Business District (CBD) or the Orchard shopping belt.

At the same time, several of Singapore’s most livable neighbourhoods lie within the RCR. These include Marine Parade with its easy access to the beach at East Coast Park and the culturally rich Joo Chiat neighbourhood; Bishan with a plethora of parks and green spaces; as well as hipster destination, Tiong Bahru, popular.

On the map (refer to Figure 1), the RCR is defined by the parts of the Central Region that fall outside of the Core Central Region (CCR), which are Districts 9, 10 and 11, as well as Sentosa. The northern boundary for the central region is Lornie Road and Ang Mo Kio Ave 1, while the western boundary is Clementi Road. In the east, Still Road and Jalan Eunos form the boundary for the Central Region.

The boundaries of the RCR are often misunderstood because they often bisect districts. Properties to the east of Still Road, such as those in Telok Kurau, are technically located in the Outside Central Region (OCR). Meanwhile, properties towards the west of Still Road, such as those located in Joo Chiat and Amber Road, are in the RCR. However, when properties are priced for sale, they are valued generally based on the district, rather than whether or not they fall within the boundaries of the Central Region.

While the boundaries might be difficult to pin down without consulting state maps, what is commonly understood is that the RCR has several popular locations that offer great value. At the same time, prices within the RCR are not in the sky-high range that properties in the CCR might have, making homeownership in the RCR possible, rather than aspirational.

In this edition of the Guru View, we take a closer look the RCR, otherwise known as the city-fringe, examining the potential of some of the locations there.

Looking at the numbers

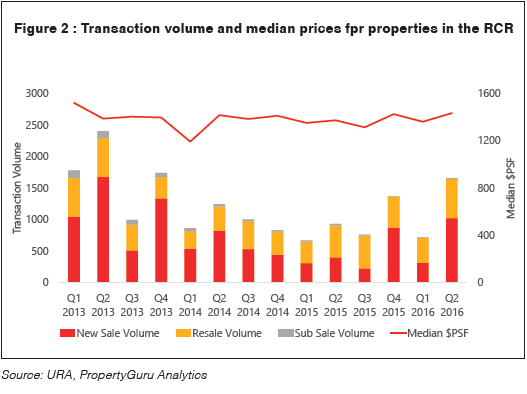

We are starting to see a recovery in transaction volume in the RCR since the beginning of the year. Year-on-year, the first half of 2016 saw a 48 percent increase in property sales over the same period in 2015, with 2,374 caveats lodged with the authorities.

Meanwhile, median prices have stayed in the $1,300 and $1,400 psf range for the last eight quarters (refer to Figure 2).

In general, this suggests a relative degree of price resiliency for properties in the RCR. This is rather different from the CCR, which saw a higher degree of price volatility due to cooling measures, or the OCR, where a much larger supply and a propensity towards cookie cutter products have slowed uptake. Indeed, some of the best performing new launches in the market have been located in the RCR.

For instance, Sustained Land’s Sturdee Residences saw a filled showflat and strong sales during its initial launch earlier this year, and has cleared about 60 percent of its units, according to developer reported figures to the Urban Redevelopment Authority (URA). Meanwhile, UOL’s Principal Garden has moved over 80 percent of their units launched on the back of competitive pricing and a strong value proposition.

Interestingly, resale performance in the RCR has also been relatively healthy, despite an overall lacklustre real estate market. In some quarters, resale volume actually outperformed new sale volume, suggesting a healthy degree of demand for older properties in the RCR. In general, older properties are favoured by certain buyers because of their larger unit sizes and proximity to amenities such as shopping malls and MRT stations.

Out of the top five best-performing projects in the RCR over the period examined, three of the projects were in the Telok Blangah area. These include The Interlace and Reflections at Keppel Bay, as well as the best-performing resale project over the period of analysis, Caribbean at Keppel Bay, which moved over 110 units over the period of analysis.

Meanwhile, about eight percent of the resale properties transacted over the period of analysis were landed property sales.

RCR rentals

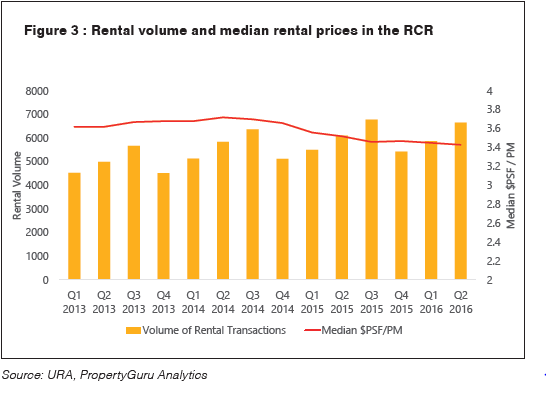

Rental volume in the RCR has seen year-on-year increases over the past 14 quarters. Q2 2016 saw a nine percent increase over the same period in 2015, which was already a five percent increase from Q2 2014. Meanwhile, rental prices fell from their peak in Q2 2014, at a median of $3.72 psf per month, to $3.43 in Q2 2016 (refer to Figure 3).

In general, while landlords of rental units in the RCR might find themselves moving downwards on prices to attract tenants to their units, or to retain current tenants, demand looks relatively healthy.

This is likely because many areas popular with expats to live in are in the RCR. These include the Amber Road area in Katong, with views of the beach; Harbourfront and Queenstown with quick access to the CBD; Upper Bukit Timah with its proximity to expat enclave Holland Village; and Upper Thomson, next to MacRitchie Nature Reserve and Singapore Island Country Club for golfers.

Areas of growth

In previous editions of the Guru View, we highlighted two particular areas of note that are within the city fringe – Little India and Geylang. With their reputation for vice, these areas have seen depressed property prices despite their many plus points. With rezoning and gentrification, especially in Geylang, property prices are set to see increases in the medium and long term.

While Singaporean homeowners, especially those with families, eschew Geylang and Little India for their reputation, they remain popular with expatriate tenants, because of their convenient locations, and distinct cultural identities.

Paya Lebar is another potential growth area that will reap benefits in the medium, and especially long term. The government has designated Paya Lebar Central as an area of growth, setting aside 12 hectares of land for commercial development. Plans for public spaces and walkways are also underway, with a pedestrian mall planned between Paya Lebar Central and Geylang Serai market.

In the long term, the state has indicated that Paya Lebar Airbase will be relocated. Currently, the height of buildings within a certain radius of airbases is kept low. When the airbase moves out of the area, the potential height of developments in the area is expected to increase. With this, real estate developers are likely to collectively purchase projects and redevelop them, at a tidy upside to property owners in the area.

Looking forward

Between the state’s plans for certain districts in the city fringe, as well as the plethora of amenities and conveniences already available, we can expect values in the area to increase in the medium and long terms. While cooling measures might have taken their toll on Singapore’s real estate market, signs of a recovery are starting to appear.

For those looking to enter the city fringe real estate market, the next six months are likely to present an interesting array of launches to choose from. Queens Peak by MCC Land is rumoured to be launching by the end of the year, while Paya Lebar Quarter, a massive mixed development right next to Paya Lebar MRT, is likely to launch next year. In the north of the RCR, Qingjian Realty is also looking to launch an as yet unnamed project on the Shunfu Ville site, which it purchased from the current residents at a collective price of $638 million.

|

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | ||