Many homeowners relocating overseas often choose to rent their homes out.

If you’re relocating overseas, one of the biggest issues is what to do with your home when you are away. In this edition of the Guru View, we run through three likely scenarios, as well as the pros and cons of each choice.

by Chang Hui Chew

For Singaporeans relocating overseas, especially if they are bringing their families along with them, the home they leave behind in Singapore is often a huge concern. Most people would choose not to sell their family homes, not only for sentimental reasons, but if anything were to happen overseas, such as the loss of employment, one’s family would still have a roof over their heads.

At the same time, renting the unit out will also create stresses and another factor to consider, in a scenario that is already stressful enough. After all, there are agents to find, tenants to negotiate with, and maintenance after.

In this issue of the Guru View, we run through a few scenarios that might work for Singaporean families moving overseas.

Scenario 1: Renting the unit out long term

This is the likeliest scenario for Singaporeans moving overseas. This allows you to continue to own the unit but at the same time, derive passive income from it that can be used for retirement savings, maintain the unit and so on.

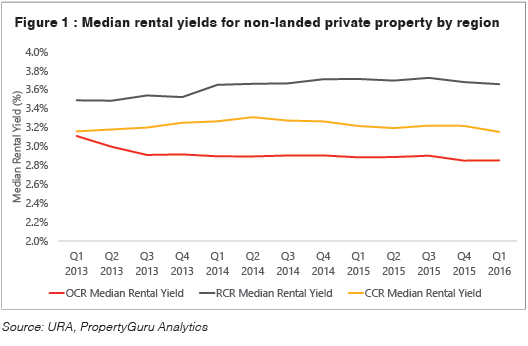

Figure 1 shows the gross median rental yield in Singapore by region. This is an indication of rental returns based on current rental and sale transaction prices. These rental yield figures indicate that most landlords should be able to cover their mortgages with rental income.

However, yield figures are on the lower side, even for the Rest of Central Region, which has slightly stronger rental performance than the rest of the island. As such, while mortgages might be covered by rental income, homeowners might still need to fork out the monthly maintenance fees out of pocket.

Homeowners should sit down and run the sums of renting out their homes, before deciding to do so. One possible alternative is to refinance your mortgage, if you are eligible, to bring down your monthly payments and increase the margin of your rental returns.

There are also a few practical considerations to keep in mind as well, before embarking on this path.

Firstly, what do you do with all the furniture in the home? We wouldn’t advise leaving too much of your personal furniture in the rental. Aside from the cost and sentimental value of these pieces, most long-term tenants will have their own furniture that they will move over.

As such, homeowners would have to find somewhere to store their existing furniture, or sell it. Self-storage units are a good option in this case, and can serve to store furniture and other bric-a-brac that you are not bringing over with you.

However, do consider leaving appliances like the refrigerator, washing machine and even the television in place. A number of tenants would not be carting these appliances with them and you are likely to command better rates, or convince a tenant to sign, if these bulky, high cost appliances were already there.

Next, it is important to think about the length of the lease. Most landlords and the real estate agents that serve them would prefer to sign standard two-year leases rather than one-year leases, to ensure that the unit is tenanted for as long as possible.

However, for those moving overseas, to leave yourself a little wiggle room, consider signing a shorter one-year lease. That way, if your stint overseas is cut short, it would not cost you too much in terms of time or money to move back into the unit. A shorter lease also allows wiggle room for selling the unit, in the event a buyer offers you a sum it would be impossible to say “no” to, to acquire the unit.

In renting out the unit, it is necessary to find a real estate agent that you can trust. Ask around for recommendations for a reliable realtor, because this individual will be your main proxy to work with the tenant on issues like maintenance, lease negotiations and so on. It might be worth it, if rental margins are healthy enough, to offer the agent a fee for the property management, including conducting occasional checks on the unit.

Scenario 2: Renting out short-term

While short term rentals of less than six months are not legal in Singapore, the continued volume of properties available on websites like Airbnb show that many landlords feel that the risks of doing so are worth it.

The primary reason that a lot of landlords continue to risk the wrath of the authorities is that the rental yields of short term rentals are higher than that of a regular longer-term tenancy, even if the unit is occupied only 20 out of 30 days a month. Given the current market, where yields are severely compressed and longer term tenants hard to come by, it is no wonder then that landlords turn to short-term rentals to avoid cash-flow issues.

Despite a poorer tenant market, tourist arrivals remain strong, which suggests a larger pool of potential tenants for short-term landlords. According to the Singapore Tourism Board, visitor arrivals between January to May of this year was 13.3 percent higher than the same period in 2015 (refer to Figure 2). In contrast the total number of foreign workers, less domestic workers and construction workers, only increased by 2.07 percent year-on-year, according to the Ministry of Manpower’s December 2015 statistics (refer to Figure 3).

For those moving overseas, one of the key reasons why short term rentals might be a viable option is the flexibility it provides. If you are returning to Singapore for a month or so, or for the various festive periods, you can reserve the period for yourself, and still have a place to live in when you are back in Singapore. If at any time, you would need to return to Singapore for a longer period, it would also be easy to just stop accepting tenants.

However, there are risks inherent to such an approach. This method remains illegal, and for Housing and Development Board (HDB) flat owners, the flat can be repossessed by the government. Landlords of private properties do face hefty fines if the Urban Redevelopment Authority (URA) investigates and finds the homeowner guilty of the offense.

Furthermore, there are logistical difficulties to be solved. The short term tenants will need to gain access, and will often require a person to let them into the development if there is security. This option would be more workable if one lived in, for instance, a walk up apartment with direct street access, or had a decent amount of separation from neighbours to prevent disturbing their privacy, which might lead to complaints.

Cleaning and maintenance services will also have to be regularly scheduled, and someone will need to be on hand to help replenish supplies like soap and so on, just like in a hotel. If there are relatives or friends that you can trust and incentivise by providing a cut of the proceeds, it would make the logistics of the matter a lot easier.

Scenario 3: Just leaving the unit be

For most people, this will be the most painless, stress-free option.

If your home is fully paid up for, or if your mortgage is a relatively low proportion of your salary, this is an option to consider. This is because you will not need the rental income, and the attendant stresses, to help to pay off your mortgage. It is therefore up to the individual homeowner whether or not the passive income from renting out the property, either short term or long term, are worth the stresses of managing it from abroad.

While this option also involves the least logistical coordination, since there are no tenants to manage or furniture to put into storage, it is not advisable to leave the house untended for too long. It would be good to have a relative or friend swing by periodically to check on the home, if only to ensure that pests and rodents have not decided to take up residence in your absence.

Conclusion

Whichever option one chooses when relocating overseas, it’s important to do the sums prior to leaving the country. Ensure that whichever option you choose, you will have enough funds you can disburse locally for mortgage payments, repairs and maintenance and so on, in the event that you are unable to tenant your unit.

Unless the country one is relocating to is a short trip from Singapore, it is also important to have a local proxy, be it a friend, family member or a real estate agent that you can trust, to act on your behalf. Frequent flights or even drives back can be incredibly taxing on one’s time and bank account balance.

Keeping a home in Singapore is a representation of one’s roots here, that it is still the country and the place to return to. Ultimately, despite the various hassles, there is definitely value in holding on to your local home.

|

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | ||