Foreign investors continue to flock to America’s biggest city as the U.S. housing recovery gathers more pace.

By Romesh Navaratnarajah

The U.S. real estate market continues to boom, with housing prices rising strongly in 2015, revealed the Knight Frank House Price Index for the second quarter of 2015.

Across the country, prices increased 4.3 percent in the year to June 2015, stated the report.

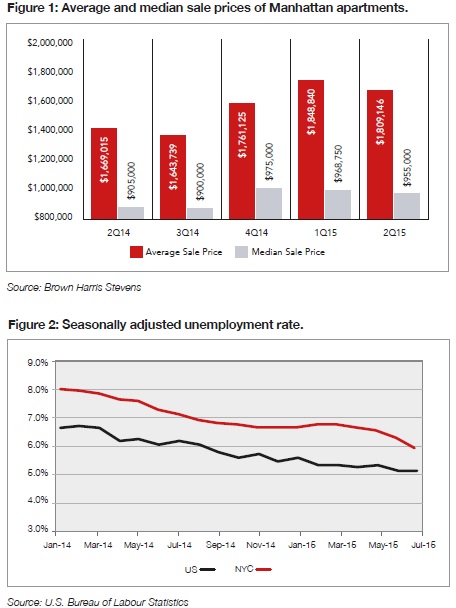

In New York City (NYC), specifically Manhattan, the average price of new and resale apartments rose eight percent year-on-year to US$1.81 million in Q2 this year, revealed a report from Brown Harris Stevens, an exclusive affiliate of Christie’s International Real Estate.

This is still lower than the record US$1.85 million seen in the quarter before, said the real estate brokerage which specialises in luxury real estate.

At the same time, median house prices in this highly sought-after location fell to US$955,000 during the second quarter from $968,750 in Q1, albeit higher than the US$905,000 in the corresponding period last year (refer to Figure 1).

The promise of security

Danielle Grossenbacher, World President of FIABCI, the International Real Estate Federation, told PropertyGuru that many foreign buyers like investing in New York City because the economy is strong and stable, while unemployment is low.

The city’s unemployment rate hit a seven-year low in July 2015, falling to 5.7 percent. “This is down from 6.1 percent in June and the lowest level since August 2008. A year ago, the unemployment rate was seven percent in NYC,” said Gregory Heym, chief economist at Brown Harris Stevens (refer to Figure 2).

Meanwhile, several recent condominium buildings there have benefitted from tax abatements. “Buildings are eligible for a 10-year exemption from property taxes, with no affordability requirement. So basically there are two years of full exemption, then two years of 80 percent tax exemption, then two years of 60 percent tax exemption, and so on,” said Grossenbacher.

She noted that demand for rental units is high among people working in the city, which means it is usually quick and easy for investors to find tenants once they acquire a property.

“Purchasers who want a secondary home are attracted by the energy of the city, its quick pace and rich cultural life. For many, the quality of education at every level is also an important factor in their decision,” she added.

Where and what are they buying?

Midtown dominated the sales of new homes in the second quarter, accounting for 33 percent of transactions. This was followed by Upper Manhattan (19.8 percent), East Side (15.7 percent), Downtown (South of 14th St) with 14.2 percent, while Downtown (34th-14th St) and the West Side contributed 9.0 percent and 8.3 percent of the deals respectively.

For resale deals, East Side Manhattan led the pack in the second quarter, accounting for 21.7 percent. This was followed by Midtown (20.7 percent) and Downtown (South of 14th St) with 20 percent. The West Side contributed 19.1 percent of transactions, while Downtown (34th-14th St) and Upper Manhattan made up 11.2 percent and 7.3 percent respectively.

Prices of co-op properties, which make up 75 percent of the Manhattan housing stock, climbed to US$1.32 million on average versus US$1.30 million in the previous quarter and US$1.22 million in Q2 2014.

As co-ops are owned by a corporation, buyers who purchase an apartment in a co-op building are actually buying shares of the corporation, and not the real property.

Specifically for studios, prices rose to US$418,662 from US$398,469 in the first quarter and US$417,542 a year ago. While resale prices of one-bedrooms dipped to US$694,068 from

US$701,182 a quarter ago, it is still higher than the US$673,905 seen last year.

For two-bedders, resale prices increased to US$1.48 million from US$1.42 million a quarter ago and $1.37 million in Q2 2014. Conversely, prices for three-bedders dipped to US$3.98 million from US$4.02 million in Q1 2015, but this is still higher than the US$3.84 million in Q2 2014.

As for resale condominiums, overall prices declined to US$2.04 million on average during the second quarter from around US$2.07 million in Q1 2015, but it surpassed the US$1.92 million recorded last year.

While resale prices of studios dropped to US$660,650 from US$661,722 in the first quarter, it still exceeds the US$632,219 in Q2 2014. For one-bedders, it fell to US$1.03 million from US$1.06 million in the first quarter and US$1.08 million last year.

Resale prices of two-bedders dropped to US$2.05 million from US$2.14 million, but it’s still higher than the US$1.93 million 12 months ago. While that for three-bedders shrank to US$4.84 million from US$4.97 million in Q1 2015, it’s still an improvement from the US$4.68 million recorded in Q2 2014.

For lofts, average resale prices rose 11 percent to US$1,562 psf from US$1,408 psf in Q2 2014, but it’s a bit softer than the US$1,570 psf witnessed in the previous quarter. Similarly, median prices increased to US$1,438 psf from US$1,366 psf a year ago, but it’s slightly weaker than the previous quarter’s US$1,477 psf.

On average, resale apartments in Manhattan spent 87 days on the market in Q2 2015, longer than the 86 days in the preceding quarter and 81 days last year.

There was also a smaller difference between asking and selling prices, as sellers achieved 99 percent of the final asking price during the period under review compared to 98.7 percent in Q1 2015 and 98.9 percent last year, added the consultancy.

Image: View of the Manhattan skyline. (Photo: Lesekreis; Wikimedia Commons)

What you need to know about U.S. taxes

Foreign buyers of U.S. housing units need to understand the country’s tax system as it may have a significant impact on their family’s wealth, says Janet Peng, managing director at US tax advisory firm Andersen Tax.

“It is widely known that the U.S. tax system is one of the most complicated and expansive systems in the world,” she noted. For instance, it taxes U.S. residents (including “green card” holders) on their worldwide income, irrespective of whether they reside in the United States. In contrast, most countries usually impose worldwide taxation on individuals who actually reside in their country and not on the basis of citizenship.

To be considered a tax resident, you need to meet either of the following tests, added Peng.

• The Lawful Permanent Resident (“green card”) Test

“You are a lawful permanent resident of the U.S. at any time if you have been given the privilege, according to the U.S. immigration laws, of residing permanently in the U.S. as an immigrant. You continue to have resident status under this test unless the status is taken away from you or is officially determined to have been abandoned. Thus, if you have a “green card” but no longer can enter the U.S. as a lawful permanent resident, you still will be treated as a resident for U.S. tax purposes and taxed on your worldwide income.”

• The Substantial Presence Test

“You meet this test if you are present in the U.S. for at least 31 days in the financial year, and 183 days during the three-year period that includes the current year, 1/3 of the days in the first year before the current year and 1/6 of the days in the second year before the current year.”

Peng warned that while U.S. immigrants are usually not provided with sufficient details about their tax filing and information return obligations before they move to the U.S. or obtain “green cards”, claiming ignorance of the rules is general not accepted as reasonable cause to eliminate civil penalties. Her advice is to seek from experienced international tax professionals.

INTERNATIONAL HIGHLIGHTS

We’ve rounded up some amazing properties for sale in New York City that will leave you breathless.

NEW PROJECTS

The Avenue Collection

1000 Avenue At Port Imperial, Weehawken, New Jersey

Type: Condominium

Developer: Lennar

Tenure: Freehold

Facilities: Grand salon lobby, concierge services, theatre/media screening room, building security system with controlled access, fitness centre with sauna and steam showers, swimming pool

Nearby Key Amenities: Eight-minute ferry ride to New York City, the shops at Riverwalk, Newport & Garden State Mall

Nearby Transport: Newark International Airport, JFK International Airport and LaGuardia Airport

Indicative Price: US$759,000 to US$3,895,000

The Avenue Collection by Lennar consists of five upscale buildings on the Hudson River in the Greater New York Metro Area.

The luxurious one-, two- and three-bedroom waterfront condominiums offer spectacular views of

skyscrapers in Manhattan and overlook the beautiful Hudson River.

It represents the centrepiece of the US$2 billion master-planned Port Imperial community, stretching over three kilometres across three towns along the Hudson.

The picturesque setting is complemented by nearby shops, restaurants and waterfront parks, and is a quick eight-minute ferry ride to Manhattan.

400 Park Avenue South

419 Park Avenue South, Manhattan, New York

Type: Condominium

Developer: Toll Brothers City Living

Tenure: Freehold

Facilities: 24-hour concierge service, fitness centre with indoor lap pool and Jacuzzi, yoga room, spin room, steam room, 27th floor sky lounge with outdoor space, golf simulator

Nearby Key Amenities: Madison Square Park, Union Square, Gramercy Park. Within walking distance to many of Manhattan’s top-rated restaurants

Nearby Transport: Access to the 6 train right outside the front entrance and within proximity to Union Square via multiple subway lines (4, 5, 6, Q, R & N)

Indicative Price: US$1.6 million

400 Park Avenue South is a fashionable new condominium designed by Pritzker-Prize winning architect Christian de Portzamparc and developed by Toll Brothers City Living.

Every detail at the high-end project has been carefully selected to create a one-of-a-kind lifestyle, from the world-class amenities and services to the thoughtfully designed studio to four-bedroom residences.

This luxurious building not only changes the Manhattan skyline, but also offers breathtaking New York City views in every direction, including the iconic Empire State Building.

|

This article was first published in the print version The PropertyGuru News & Views. Download PDF of full print issues or read more stories now! | ||