The Philippines continues to show very strong investment potential.

By Romesh Navaratnarajah

The Philippine property market continues to entice buyers from Singapore, most of whom are Filipino professionals working here, but also a growing number of Singaporean investors and locally-based foreigners putting their money in the Philippines.

This keen interest has been seen at PropertyGuru’s Philippine Property Shows in the past, which have attracted large crowds and strong sales.

Competitive advantage

Property values in the country have been going up in recent years, anchored by strong economic growth. This year, the Philippine economy is expected to expand 5.5 percent, outpacing the rest of Asia, alongside ongoing major population growth and rapid urbanisation.

Less strict rules on foreign property ownership, low entry prices compared to Singapore, good capital appreciation, and possessing Asia’s highest rental yields at around 7.5 percent on average have also been cited as reasons why buyers are taking a keen interest in Philippine properties.

According to Cushman & Wakefield (C&W), the affordable condo market has attracted middle-income buyers and OFW (Overseas Foreign Worker) households. In fact, the property consultancy highlighted that strong investment from OFWs in the Middle East is expected to be the country’s main growth driver. “As much as a third of remittances from Filipino expats in the Arabian Gulf are flowing into property developments in the Philippines.”

To cater for this demand, Metro Manila has seen a rising number of reasonably priced condominiums designed for start-up families, first-time buyers and young professionals from the predominantly ‘C’ socio-economic class.

“The construction sector remains active as new condominiums are being built. It is estimated that there are around 130,000 condominiums in the pipeline across Metro Manila,” stated a report by KMC MAG Group Research, an international associate of Savills.

Location matters

The majority of investors are focusing on the central business districts of Makati, Bonifacio Global City (BGC) and Ortigas, due to their prime locations close to shopping malls, offices and transport networks. Moreover, land values in these areas have been projected to grow 6.5 to 8.5 percent year-on-year from Q4 2014, said property firm Colliers International Philippines.

Moving forward, the Philippines is expected to benefit from a strong economy, growing BPO (Business Process Outsourcing) sector, stable influx of remittances and steady exchange rates.

Understandably, there are several buying restrictions of which overseas nationals must be aware. Foreign ownership is restricted at 40 percent within a residential building and only condominiums can be sold to foreigners as they cannot purchase landed property. Ownership of land is reserved for Filipino citizens.

While there is a wide array of investment opportunities, it pays to be selective and find a good real estate broker to help identify the right property and negotiate the best deal.

CITY FAST FACTS

(METRO MANILA)

• Population: Around 12 million

• Total area: 636 sq km

• Currency: Philippine Peso (PHP)

• GDP per capita: US$3,000 (2015)

• GDP growth: 5.5 percent (2015)

• Future transport: North-South Railway project targeted for 2020

• Home prices: Up as much as six percent this year

• Distance from Singapore: 2,395 km

INTERNATIONAL HIGHLIGHT – NEW PROJECT

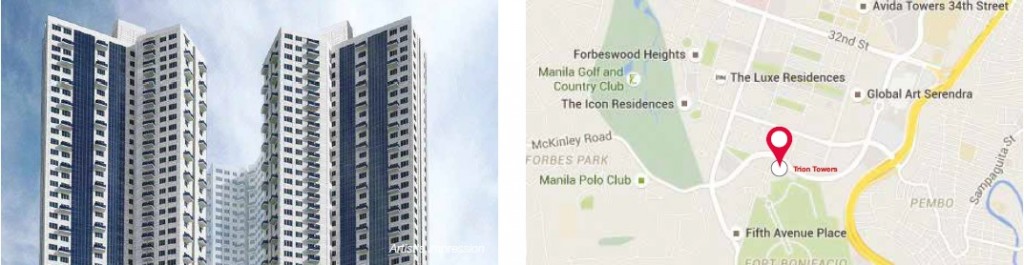

Trion Towers

8th Avenue Corner, McKinley Parkway, Bonifacio Global City, Taguig

Type: Condominium

Developer: Robinsons Land Corp.

Tenure: Freehold

Facilities: Indoor fitness arena, tranquility pool, spa and sauna rooms, high-definition screening room

Nearby Key Amenities: Bonifacio High Street (fashionable boutiques and restaurants), St Luke’s Hospital

Nearby Transport: Manila Ninoy Aquino International Airport

Starting Price: US$77,650

The 2,103-unit Trion Towers by Robinsons Land comprises three high-rise towers that offer breath-taking views of the city skyline.

Its one- to three-bedroom apartments feature large, airy and light-filled spaces with sizes ranging from approximately 405 sq ft to 1,277 sq ft.

There are a wide range of fitness facilities such as an indoor exercise and dance room, cardio and workout rooms, and boxing room.

This one hectare development is within walking distance to shops and restaurants at Fort Strip and Bonifacio High Street.

|

This article was first published in the print version The PropertyGuru News & Views. Download PDF of full print issues or read more stories now! | ||