Private residential prices in Singapore appear to have “decoupled” from the worldwide chase for property rental yields since 2013, as wealthy foreign buyers continue to exert their influence on the city state, according to The Business Times citing a study by the International Monetary Fund (IMF).

According to the IMF study, the decoupling was brought about by Singapore regulators implementing macroprudential measures—such as the Additional Buyer’s Stamp Duty (ABSD)—that targeted foreign speculators and buyers, who were the pacemakers behind the asset chase on Singapore properties.

The report showed that an unmitigated increase in residential property prices, without the presence of intervention such as cooling measures, could have further fueled foreign buyer appetite for the property market in Singapore.

Prices in the private residential property market grew by almost 16% from 2010 to 2013, according to the report. During this period, speculative activity and interest from foreign buyers were high, as indicated by the huge shares of short-term resales. Foreigners accounted for nearly 20% of all transactions back in 2011, said the IMF report.

Foreign buyers continue to wield price influence despite lower demand

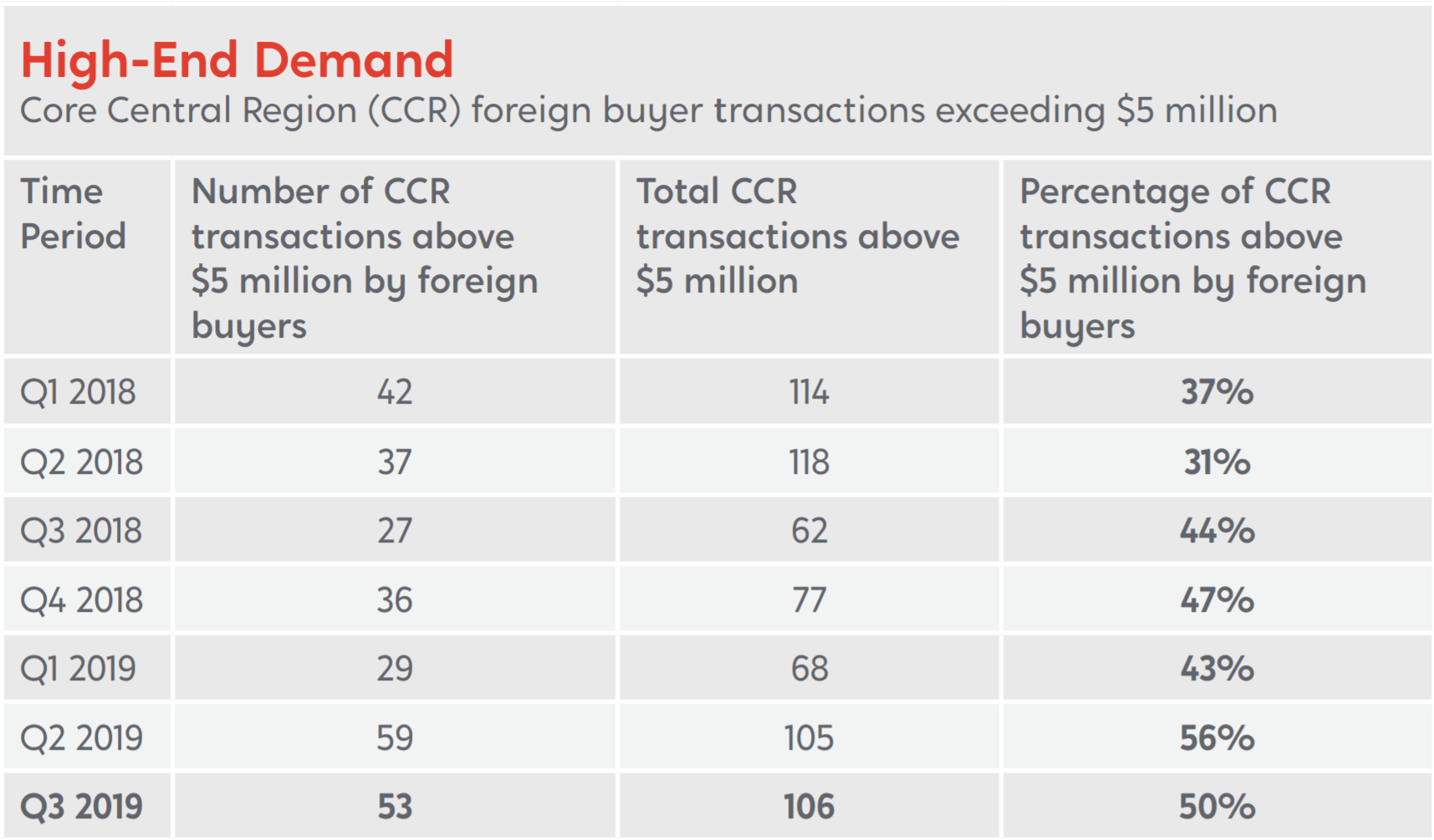

Meanwhile, PropertyGuru and URA data showed that foreign buyers continue to account for about half of the transaction volume for properties above $5 million in the Core Central Region (CCR) of Singapore.

Overall, the IMF report stated that foreign buyers’ share of transactions accounted for 5% to 6% of total transactions for the first three quarters of 2019. According to the report, foreigners’ purchases were seen to have the biggest influence on the growth of residential property prices, with the effects deemed “economically significant”.

Apart from that, property speculators were also one of the biggest influences on property prices. Property ‘flippers’, despite making up only about 5% to 6% of resale transactions between 2004 and 2012, can influence property prices by creating a positive feedback to landlord-investors and owner-occupiers.

“In these cases, the growth of residential property prices would be positively correlated with transactions,” said the report.

Nevertheless, a runaway property price increase akin to property markets such as Hong Kong, Sydney and Vancouver appears to have been averted. “By targeting risk sources such as the transactions of speculators, corporates and foreigners via stamp duty, cooling measures introduced by the Singapore regulator since 2013 have limited excessive property price increases,” said the report.

RECOMMENDED READ: Foreigners Just Bought These 4 SG Luxury Condos At Crazy Prices

Looking for a property in Singapore? Visit PropertyGuru’s Listings, Project Reviews and Guides.

Victor Kang, Digital Content Specialist at PropertyGuru, edited this story. To contact him about this or other stories, email victorkang@propertyguru.com.sg