Buyers rushing to submit their cheques at Riverfront Residences before the 12am deadline to avoid the revised ABSD rates. (Photo: Jeanice Ong)

The government has raised the Additional Buyer’s Stamp Duty (ABSD) rates and tightened the Loan-to-Value (LTV) limits on residential property purchases, in a bid “to cool the property market and keep price increases in line with economic fundamentals”.

Prices for private housing in Singapore rose by 9.1 percent over the past year, while demand witnessed a strong recovery. Transaction volumes had also been on the uptrend.

More: MAS Calls For Caution Amidst “Euphoria” In Singapore Property Market

“The sharp increase in prices, if left unchecked, could run ahead of economic fundamentals and raise the risk of a destabilising correction later, especially with rising interest rates and the strong pipeline of housing supply,” said the Ministry of Finance, Ministry of National Development and Monetary Authority of Singapore (MAS) in a joint statement.

While analysts had anticipated the move, they did not expect it to arrive this early.

“After (Tuesday’s) remarks from MAS’s Mr Ravi Menon, we sort of expected that the government may step in; but did not expect it to be so immediate,” said ERA Realty key executive officer Eugene Lim.

He noted that the government may have brought the measures forward as they expect things to worsen in the event the US-China trade war gathers pace and interest rates increase over time.

“Biting the bullet now perhaps may prevent more damage later should things not pan out favourably for Singapore,” he said.

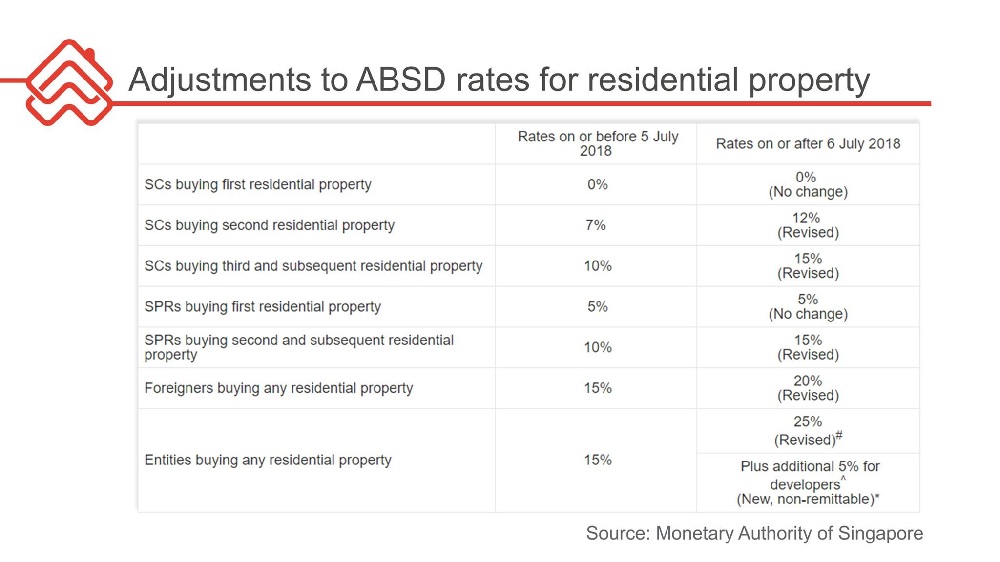

The current ABSD rates for Singapore citizens and Singapore permanent residents buying their first residential property will remain at zero and five percent respectively.

However, the ABSD rates for all other individuals will be raised by five percentage points and 10 percentage points for entities.

An additional ABSD of five percent that is non-remittable under the remission rules will be introduced for developers acquiring residential properties for housing development.

For purchases jointly made by two or more parties of different profiles, the highest applicable ABSD rate will apply.

However, full ABSD remission will still be provided for joint purchases of the first residential property by married couples with at least one Singapore citizen spouse.

Married couples with at least one Singapore citizen spouse, who jointly acquired a second home can still apply for a refund of ABSD, provided they sell their first house within six months following the date of purchase of the second property, or the issue date of the Temporary Occupation Permit or Certificate of Statutory Completion of the second property, whichever is earlier.

While the new rates are effective today (6 July), there will be a transitional provision for cases where the OTP had already been granted by sellers to potential buyers on or before 5 July.

Meanwhile, the government tightened the LTV limits by five percentage points for all housing loans provided by financial institutions. The statement noted that the revised LTV limits will not apply to loans granted by the Housing Board.

The new LTV limits will apply to loans for residential property acquisitions where the Option to Purchase is granted on or after 6 July.

In view of the tighter LTV limits for housing loans, LTV limits for mortgage equity withdrawal loans will be tightened to 75 percent for a borrower with no outstanding housing loan for the acquisition of another home, and 45 percent for a borrower with an outstanding housing loan.

PropertyGuru’s chief business officer Lewis Ng expects the recovery in the private property market to cool following the revision of the ABSD rates.

“The revision to ABSD rates is likely to lead to a slowdown in the recovery of the private property market, which saw a quarter-on-quarter increase of 3.4 percent in the second quarter of the year,” he said.

“For a second property buyer looking to buy a one-million-dollar unit, this will translate to an additional $50,000 in cash, and a total stamp duty outlay of $160,000, including buyer’s stamp duty.”

He noted that while the ABSD revision is aimed at tempering exuberant investor activity, “the addition of five percent to mortgage LTV ratios will also increase the financial burden on home seekers looking to buy a home for owner occupancy”.

“This additional five percent will need to be borne in cash or CPF monies, which will further constrain budgets,” he said. “While this might be painful for home seekers in the short term, it will enforce financial prudence and create a more stable property market.”

Home buyers looking for Singapore Properties may like to visit our Listings, Project Reviews and Guides.

Romesh Navaratnarajah, Senior Editor at PropertyGuru, edited this story. To contact him about this or other stories, email romesh@propertyguru.com.sg