Just like how there are tell-tale signs which convey the degree of profitability for a particular investment, vacancy rates can provide a brief glimpse into the health of the rental market. Often either referring to completed units but unsold by developers or homes purchased by buyers but are unoccupied, vacancy rates are vital statistics to look at because there is a positive correlation between the occupancy rate and rent prices.

If a private residential project has less than 10 per cent of its units occupied even though over 90 percent have been sold, it gives a clear signal to investor landlords and property developers of the worsening state of the rental market given the difficulties in leasing out these units. On the other hand, a lower vacancy rate will work in their favour as a shortfall in supply of private units will drive rents up.

Private and public housing 2014: Leasing demand on the rise

It seems like the first scenario where supply surpasses demand is a more accurate representation of the rental market in 2014. Unlike the sluggish private non-landed residential sales market, the leasing market remained fairly buoyant throughout the year. Transaction rent volume for private residential properties achieved a new record of 57,463 units in 2014, a marginal increase of 1.57 percent as compared to the year before. Much of the rise was due to a 4.9 percent year-on-year increase in leases in the OCR where most mass market condominiums are. Leases in the Rest of Central Region RCR also fared well, accounting for 55 percent of total rent transactions.

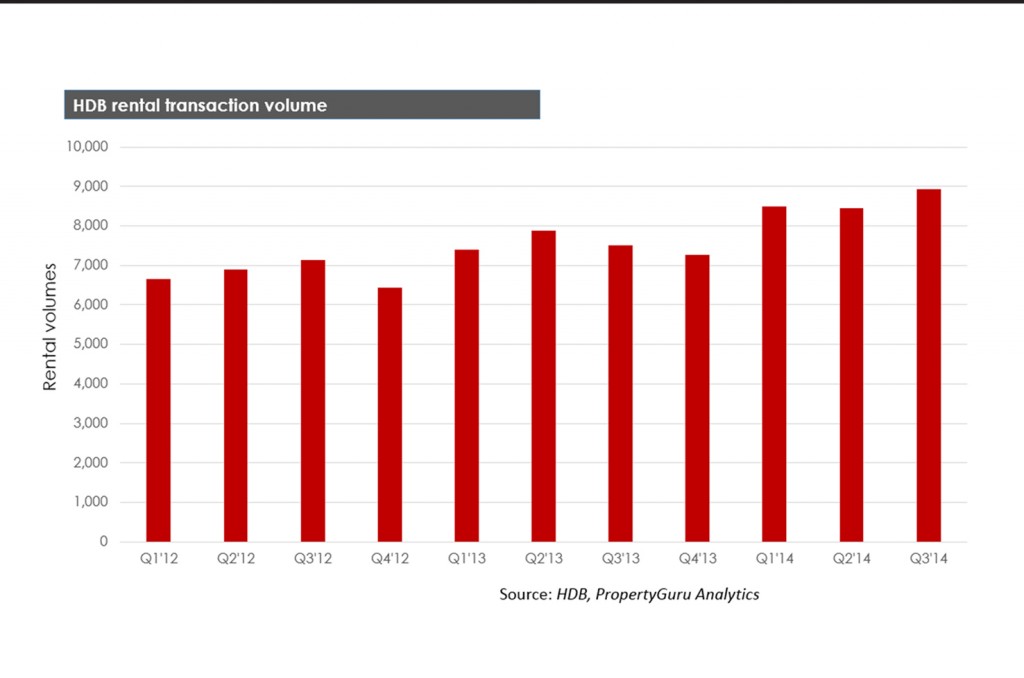

HDB subletting units also displayed a similar picture. Although overall HDB resale volumes have fallen, rental volume has increased. Rental transactions have been fairly stable throughout the year, averaging at an estimated 8,600 units per quarter. In total, a record 34,463 HDB flats were rented in 2014, the highest annual figure so far, an increase of 14.6 percent in comparison to 2013. Larger HDB units, in particular 5-room and executive flats, are the main contributors to this rise with a 15.9 percent and 15.4 percent y-o-y increase respectively.

Private and public housing 2014: Rent prices heading south

But while rental volume has grown in the private and public residential housing market, it has not translated into an increase in rents. Prices for HDB rental units have stayed relatively flat owing to the increasing supply of flats eligible for subletting whereas rents for condos have fallen across the board.

For private property, rents declined by 3 percent from 2013 levels. Average rent trended downwards 0.8 percent in Q3, followed by a 1.1 percent decline in Q4 2014. Looking deeper into the different regions, rental prices for suburban units slid by the widest margin year-on-year by 6.4 percent, followed by city fringe homes at 4.2 percent and those in the prime districts by 3.4 percent.

As for rent prices for HDB flats, there has been a marginal dip of 2.1 percent in 2014 compared to the year prior. The fall in prices are largely attributed to the popularity of the larger 5-room and executive flats, both of which saw significantly greater declines of 2.6 percent and 3.1 per cent respectively.

To read more about the property outlook for 2015, download the PropertyGuru Property Outlook Report 2015 eBook here

Adam Rahman, Senior Content Marketing Executive at PropertyGuru, edited this story. To contact him about this or other stories, email adam@propertyguru.com.sg