The Tate Residences: 5 Units for Sale

Refining your recommendations.

This may take a few seconds...

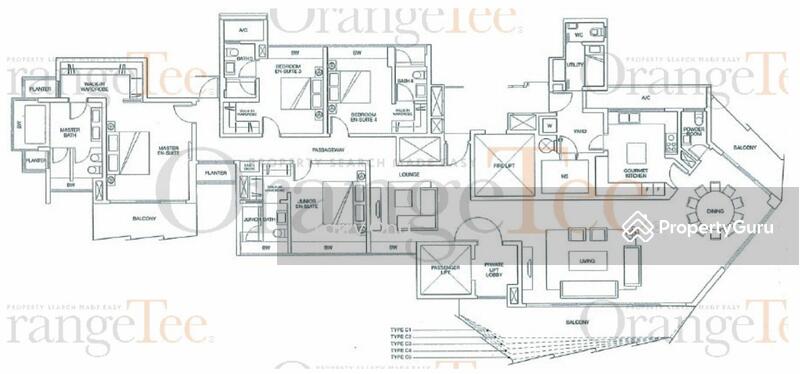

Located at Claymore Road, 229546, Orchard / Holland (D09-10), The Tate Residences is a freehold condominium in District 09. This property was completed in 2010, and was developed by Hong Leong Holdings Limited. There are a total of 85 beautiful units spread across 35 storeys here at The Tate Residences. The Tate Residences is a freehold condominium strategically located close to the Orchard Road Shopping District making it nearby an abundance of amenities, which is extremely convenient for residents here. This development is an ideal living space for individuals as well as families and would also be of interest to those who intend to invest in the property market. The Tate Residences offers its residents several condo facilities. There is a glistening swimming pool that is perfect for a refreshing and rejuvenating time after a long day’s work. Families with young children can head over to the playground and the wading pool for hours of fun. For residents who want to keep fit, there are tennis courts as well as a well-equipped gymnasium. There is a reflexology path for those who prefer something less strenuous. The barbeque area allows residents to cook delicious meals for friends and family. There is also 24 hour security to ensure the safety of residents and their homes. The Tate Residences is a sanctuary that allows residents to return to a peaceful and quiet home, but yet still enjoy all the conveniences that city life has to offer. The Tate Residences is easily accessible via public transportation. The closest MRT Station is the Orchard MRT Station which is just an 8 minutes’ walk away (610m). The Tate Residences is also easily accessible by bus. There are several bus stops nearby, such as the Thong Teck Building bus stop and Royal Plaza on Scotts bus stop both of which are just 4 minutes’ walk away. Other bus stops that are nearby include the Royal Thai Embassy bus stop, the Delfi Orchard bus stop and the Far East Plaza bus stop, all of which are less than 5 minutes’ walk away. For residents with private vehicles, The Tate Residences is easily accessible via main roads such as Grange Road, Tanglin Road and Stevens Road. It also enjoys good connectivity to the surrounding areas as well as to the other parts of Singapore via major expressways such as the Central Expressway and the Pan Island Expressway. Via Grange Road, The Tate Residences is just a short drive to the Orchard Road Shopping District where there are plenty of retail outlets, eateries and other amenities, as well as to the Central Business District. Muddy Murphy’s Irish PubThe Line RestaurantThe Song of IndiaSalt Grill & Sky BarHard Rock Cafe ISS International SchoolFuren International SchoolRaffles’ Girls SchoolChinalingua SchoolJoinus Language School Palais RenaissanceForum The Shopping MallTangling Shopping CentreParagon Shopping CentreFar East Plaza The Tate Residences is a freehold condominium located in District 09 that was developed by Hong Leong Holdings Limited. This project was completed in 2010 and has a total of 85 units. The sub sale price for units here range between S$5,200,000 to S$9,000,000 per unit, while the rental price range is between S$9,000 to S$35,000 per unit. Project Name: The Tate ResidencesType: CondominiumDistrict: 09Configuration: 85 units Unit Types:3 bedrooms, 3 bathrooms (1,800 to 2,300 square feet)3 bedrooms, 4 bathrooms (1,800 to 2,300 square feet)4 bedrooms, 4 bathrooms (approx. 3,000 square feet)4 bedrooms, 5 bathrooms (approx. 3,000 square feet) Other projects by the same developer as The Tate Residences includeThe JovellMidwoodOne Balmoral Other developments that are located in the same neighbourhood as The Tate Residences that are worth checking out include8 St ThomasMartin ModernScotts SquareThe Ritz-Carlton ResidencesTwentyOne Angullia ParkHaus On Handy

DeveloperHong Leong Holdings