131 Pasir Ris Street 11

131 Pasir Ris Street 11

S$ 938,000

Negotiable4

Beds

2

Baths

1,582

sqft (floor)

S$ 593

psf (floor)

660 m (8 mins) from CR4 Pasir Ris East MRT

About this property

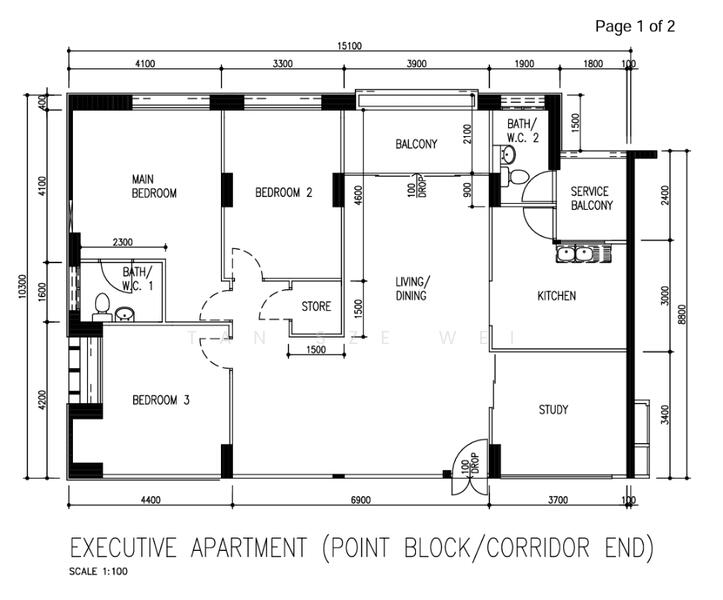

Executive Apartment 4 bedrooms with balcony

Very efficient squarish layout. Ideal for buyers to renovate to your own taste and style to suit your lifestyle.

Blk 131 is in close proximity to many amenities around Pasir Ris, like Pasir Ris Central Hawker Centr, a few giant and NTUC supermarts, Loyang point & White Sands shopping mall are just within walking distance.

Recreation and entertainment are also easily accessible with Pasir Ris East CC in close proximity. If greenery is important to you, you will be delighted there are 2 parks in the vicinity of 131 Pasir Ris Street 11. Having Pasir Ris Town Park and Tampines Eco Green close by, you can be sure to enjoy peaceful and open environment satisfaction with your love ones.

Blk 131 is in close proximity to many amenities around Pasir Ris, like Pasir Ris Central Hawker Centr, a few giant and NTUC supermarts, Loyang point & White Sands shopping mall are just within walking distance.

Recreation and entertainment are also easily accessible with Pasir Ris East CC in close proximity. If greenery is important to you, you will be delighted there are 2 parks in the vicinity of 131 Pasir Ris Street 11. Having Pasir Ris Town Park and Tampines Eco Green close by, you can be sure to enjoy peaceful and open environment satisfaction with your love ones.

Affordability

Can I afford this property?

Tell us your monthly income and expenses to see if this home fits your budget.

Mortgage breakdown

Est. monthly repayment

S$ 0 / mo

S$ 0 Principal

S$ 0 Interest

Upfront costs

Total downpayment

S$ 0

Downpayment

S$ 0 Loan amount at 0% Loan-to-value

131 Pasir Ris Street 11

131 Pasir Ris Street 11

View project detailsFAQs

The sale price of this unit at 131 Pasir Ris Street 11 is S$ 938,000.

Current PSF at 131 Pasir Ris Street 11 is about S$ 592.92 psf.

The estimated loan repayment is S$ 2,797 / mo.

131 Pasir Ris Street 11 is located at 131 Pasir Ris Street 11 Pasir Ris / Tampines Changi / Pasir Ris (D17-18).

Floor size of this unit at 131 Pasir Ris Street 11 is 1,582 sqft.

Explore other options in and around Pasir Ris / Tampines

Based on the property criteria, you might be interested on the following

HDB Flat For Sale

Show MoreNearest MRT Stations